Supportive Regulatory Framework

A supportive regulatory framework in Spain is fostering growth in the live cell-encapsulation market. The Spanish Medicines Agency (AEMPS) has been proactive in establishing guidelines that facilitate the development and approval of innovative therapies, including those utilizing live cell-encapsulation technologies. This regulatory environment encourages research and development, as companies feel more secure in investing in new technologies. The live cell-encapsulation market is likely to benefit from streamlined approval processes, which could reduce time-to-market for new products. As a result, the market may see an increase in new entrants and innovations, potentially leading to a market growth of 10% over the next few years.

Innovations in Drug Delivery Systems

Innovations in drug delivery systems are significantly impacting the live cell-encapsulation market. Advanced encapsulation techniques are being developed to improve the targeted delivery of therapeutics, which is crucial for enhancing patient outcomes. In Spain, research institutions and companies are increasingly focusing on creating more efficient delivery mechanisms that utilize live cell-encapsulation technologies. This innovation is expected to lead to a more effective treatment landscape, particularly in oncology and chronic diseases. The live cell-encapsulation market is likely to see a surge in demand as these new systems are integrated into clinical practices, potentially increasing market value by 15% over the next five years.

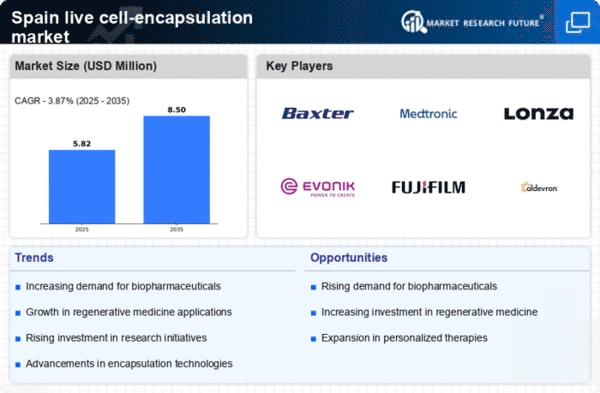

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals in Spain is a key driver for the live cell-encapsulation market. As the healthcare sector evolves, there is a notable shift towards biologics, which are often more effective than traditional pharmaceuticals. This trend is supported by a growing population that is more health-conscious and increasingly seeking advanced treatment options. The live cell-encapsulation market is poised to benefit from this demand, as encapsulation technologies enhance the stability and efficacy of biopharmaceuticals. In 2025, the biopharmaceutical market in Spain is projected to reach approximately €10 billion, indicating a robust growth trajectory that could further stimulate investments in live cell-encapsulation technologies.

Increased Focus on Personalized Medicine

The increased focus on personalized medicine is driving growth in the live cell-encapsulation market. As healthcare shifts towards tailored treatments, the need for technologies that can deliver specific therapies to individual patients becomes paramount. Live cell-encapsulation technologies offer the potential to customize drug delivery, enhancing the effectiveness of treatments based on genetic and phenotypic profiles. In Spain, healthcare providers are increasingly adopting personalized approaches, which is likely to boost the demand for encapsulation solutions. The live cell-encapsulation market may experience a growth rate of around 12% annually as personalized medicine continues to gain traction in clinical settings.

Growing Investment in Regenerative Medicine

The growing investment in regenerative medicine is a significant driver for the live cell-encapsulation market. Spain has been witnessing an increase in funding for research and development in this field, with both public and private sectors recognizing the potential of regenerative therapies. Live cell-encapsulation technologies play a crucial role in the development of these therapies, as they can protect and deliver live cells effectively. The Spanish government has allocated substantial resources to support regenerative medicine initiatives, which could lead to a market expansion of approximately 20% by 2027. This trend indicates a promising future for the live cell-encapsulation market as it aligns with national health priorities.