Advancements in Treatment Modalities

Technological advancements in treatment modalities are reshaping the inflammatory bowel-disease-treatment market. The introduction of new therapeutic agents, including biologics and small molecules, has revolutionized the management of IBD. These innovations offer improved efficacy and safety profiles, which are crucial for patient adherence and overall treatment success. For instance, the emergence of targeted therapies has shown promising results in clinical trials, leading to increased interest from healthcare providers. Furthermore, the Spanish healthcare system is increasingly adopting these advanced treatments, which may lead to a shift in prescribing patterns. As a result, the market is likely to witness a surge in demand for these innovative therapies, reflecting the ongoing evolution of treatment options available for patients with IBD.

Growing Awareness and Education Initiatives

The growing awareness and education initiatives surrounding inflammatory bowel disease are pivotal in driving the inflammatory bowel-disease-treatment market. Increased public and professional understanding of IBD has led to earlier diagnosis and treatment, which is essential for improving patient outcomes. Various organizations in Spain are actively promoting awareness campaigns, which have resulted in heightened recognition of symptoms and the importance of seeking medical advice. This shift in awareness is likely to lead to an increase in diagnosed cases, thereby expanding the market. Additionally, healthcare professionals are receiving more training on IBD management, which may enhance treatment efficacy and patient satisfaction. Consequently, the focus on education and awareness is expected to positively influence the growth trajectory of the inflammatory bowel-disease-treatment market.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is a significant driver of the inflammatory bowel-disease-treatment market. The Spanish regulatory authorities have been increasingly favorable towards the approval of new treatments, particularly those that demonstrate substantial clinical benefits. This supportive environment encourages pharmaceutical companies to invest in research and development, leading to a more diverse range of treatment options for patients. The expedited approval processes for breakthrough therapies are particularly noteworthy, as they allow for quicker access to essential medications. As a result, the market is likely to experience accelerated growth, with new therapies entering the market more rapidly than in the past. This trend not only benefits patients but also stimulates competition among manufacturers, potentially leading to better pricing and availability of treatments.

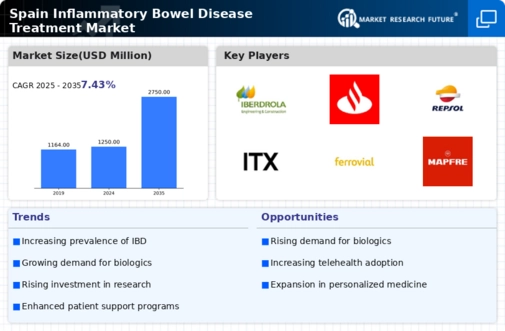

Increasing Prevalence of Inflammatory Bowel Disease

The rising incidence of inflammatory bowel disease (IBD) in Spain is a critical driver for the inflammatory bowel-disease-treatment market. Recent studies indicate that the prevalence of IBD has increased significantly, with estimates suggesting that around 0.5% of the population is affected. This growing patient population necessitates the development and availability of effective treatment options. As more individuals are diagnosed, healthcare providers are compelled to seek innovative therapies, thereby stimulating market growth. The increasing burden of IBD on healthcare systems also prompts government and private sector investments in research and development, further enhancing the treatment landscape. Consequently, the expanding patient base is likely to drive demand for both existing and novel therapies in the inflammatory bowel-disease-treatment market.

Economic Factors Influencing Treatment Accessibility

Economic factors play a crucial role in shaping the inflammatory bowel-disease-treatment market. In Spain, the healthcare system is primarily publicly funded, which influences the accessibility of treatments for patients. Economic constraints can impact the availability of certain therapies, particularly newer and more expensive options. However, the Spanish government has been making efforts to allocate more resources towards the management of chronic diseases, including IBD. This increased funding may enhance patient access to necessary treatments, thereby driving market growth. Additionally, the rising costs associated with managing IBD, including hospitalizations and long-term care, highlight the need for effective treatment solutions. As economic conditions evolve, the market may see shifts in treatment accessibility, which could significantly impact patient outcomes and overall market dynamics.