Growing Awareness of Joint Health

There is a rising awareness among the Spanish population regarding joint health and the importance of early intervention for hip disorders. Educational campaigns and community health programs are encouraging individuals to seek medical advice sooner, leading to increased diagnoses and subsequent demand for hip implants. This trend is particularly evident in urban areas, where access to healthcare information is more prevalent. As awareness continues to grow, the hip implants market is likely to see a surge in demand, with estimates suggesting a 10% increase in procedures over the next few years as more patients opt for surgical solutions.

Rising Incidence of Hip Disorders

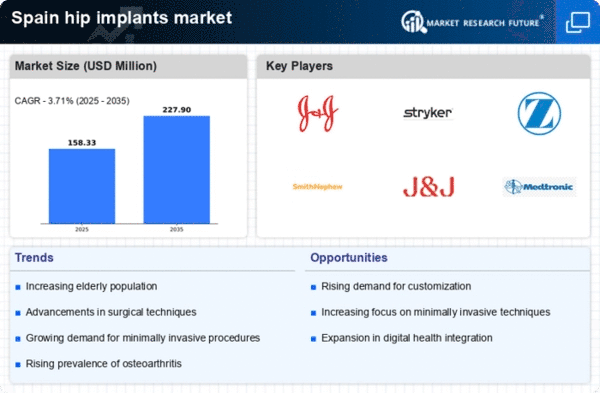

The increasing prevalence of hip disorders in Spain is a primary driver for the hip implants market. Conditions such as osteoarthritis and rheumatoid arthritis are becoming more common, particularly among the aging population. According to recent health statistics, approximately 20% of individuals over 65 in Spain experience significant hip-related issues. This trend is likely to escalate the demand for hip implants, as patients seek surgical interventions to restore mobility and alleviate pain. The hip implants market is thus positioned to grow, with projections indicating a potential increase in market value by 15% over the next five years, driven by the need for effective treatment options.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in Spain are positively impacting the hip implants market. Increased funding for orthopedic surgeries and rehabilitation programs is facilitating access to hip replacement procedures. The Spanish government has allocated approximately €500 million for orthopedic care in the upcoming fiscal year, which is likely to enhance the availability of hip implants. This financial support is crucial for hospitals and clinics, enabling them to invest in high-quality implants and training for medical staff. Consequently, the hip implants market is expected to experience growth as more patients receive timely and effective treatment.

Increase in Sports-Related Injuries

The rise in sports participation and physical activities among the Spanish population is contributing to an increase in sports-related injuries, particularly hip injuries. As more individuals engage in high-impact sports, the incidence of hip fractures and other related injuries is on the rise. This trend is prompting a greater need for hip implants, as athletes and active individuals seek surgical options to return to their previous levels of activity. The hip implants market is thus expected to expand, with projections indicating a potential growth of 8% annually as the demand for effective treatment solutions continues to rise.

Technological Innovations in Implant Design

Innovations in the design and materials used for hip implants are significantly influencing the hip implants market. Advanced materials such as titanium and ceramic composites are being utilized to enhance durability and biocompatibility. Furthermore, the introduction of minimally invasive surgical techniques is improving patient outcomes and reducing recovery times. In Spain, the adoption of these technologies is expected to increase, with a projected market growth rate of 12% annually. The hip implants market is thus benefiting from these advancements, as healthcare providers and patients alike seek the latest solutions for hip replacement surgeries.