Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in Spain are playing a pivotal role in the endoscopic retrograde-cholangiopancreatography market. Increased funding for healthcare facilities and programs focused on gastrointestinal diseases is likely to enhance access to advanced diagnostic and therapeutic procedures. The Spanish government has allocated substantial budgets to improve medical technologies and training for healthcare professionals. This financial support is expected to facilitate the adoption of endoscopic retrograde-cholangiopancreatography techniques across various healthcare settings. Moreover, public health campaigns aimed at raising awareness about biliary disorders are likely to drive patient referrals for endoscopic procedures. As a result, the endoscopic retrograde-cholangiopancreatography market may witness a surge in demand, supported by these proactive governmental measures.

Advancements in Endoscopic Technology

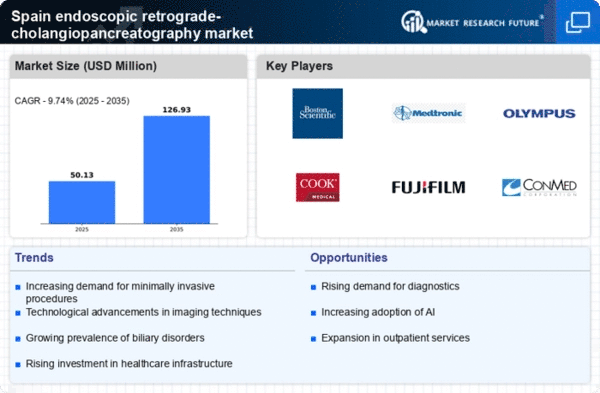

Technological innovations in endoscopic equipment are significantly influencing the endoscopic retrograde-cholangiopancreatography market. The introduction of high-definition imaging, improved endoscopes, and minimally invasive techniques enhances the accuracy and safety of procedures. In Spain, hospitals are increasingly adopting these advanced technologies to provide better diagnostic capabilities and treatment options. For instance, the integration of artificial intelligence in endoscopic procedures is expected to improve detection rates of biliary pathologies. The market for endoscopic devices is projected to grow at a CAGR of around 8% over the next few years, driven by these advancements. As healthcare facilities invest in state-of-the-art equipment, the endoscopic retrograde-cholangiopancreatography market is poised for substantial expansion, catering to the evolving needs of healthcare providers and patients alike.

Rising Incidence of Biliary Disorders

The increasing prevalence of biliary disorders in Spain is a crucial driver for the endoscopic retrograde-cholangiopancreatography market. Conditions such as gallstones, cholangitis, and pancreatitis are becoming more common, leading to a higher demand for diagnostic and therapeutic procedures. According to recent health statistics, biliary disorders affect approximately 10-15% of the population in Spain, which translates to millions of individuals requiring medical intervention. This growing patient base necessitates advanced endoscopic techniques, thereby propelling the market forward. Furthermore, the aging population is particularly susceptible to these conditions, further amplifying the need for effective treatment options. As healthcare providers seek to improve patient outcomes, the endoscopic retrograde-cholangiopancreatography market is likely to experience significant growth in response to these rising incidences.

Growing Demand for Minimally Invasive Procedures

The trend towards minimally invasive surgical techniques has significantly impacted the endoscopic retrograde-cholangiopancreatography market. Patients in Spain are increasingly favoring procedures that offer reduced recovery times and lower risks of complications. Endoscopic retrograde-cholangiopancreatography, being a minimally invasive option for diagnosing and treating biliary disorders, aligns well with this patient preference. The market is likely to benefit from the rising awareness among patients regarding the advantages of such procedures, including shorter hospital stays and quicker return to daily activities. As healthcare providers adapt to these changing patient expectations, the endoscopic retrograde-cholangiopancreatography market is expected to grow, driven by the demand for safer and more efficient treatment options.

Increased Collaboration Between Healthcare Providers

Collaboration among healthcare providers, including hospitals, clinics, and research institutions, is emerging as a key driver for the endoscopic retrograde-cholangiopancreatography market. In Spain, partnerships aimed at sharing knowledge, resources, and best practices are likely to enhance the quality of care for patients with biliary disorders. Such collaborations can lead to the development of standardized protocols and training programs, improving the overall efficacy of endoscopic procedures. Additionally, joint research initiatives may foster innovation in endoscopic technologies and techniques, further propelling market growth. As healthcare entities work together to optimize patient outcomes, the endoscopic retrograde-cholangiopancreatography market is expected to thrive, benefiting from enhanced expertise and shared advancements.