Rising Healthcare Expenditure

The rise in healthcare expenditure in Spain is a crucial factor influencing the dyspepsia market. With healthcare spending increasing by around 5% annually, more resources are allocated to gastrointestinal health, including dyspepsia management. This trend is likely to enhance access to diagnostic tools and treatment options for patients. As healthcare facilities improve their services and expand their offerings, patients may experience better outcomes and increased satisfaction. Consequently, the dyspepsia market is expected to grow as more individuals seek medical attention for their symptoms, supported by a healthcare system that prioritizes gastrointestinal health.

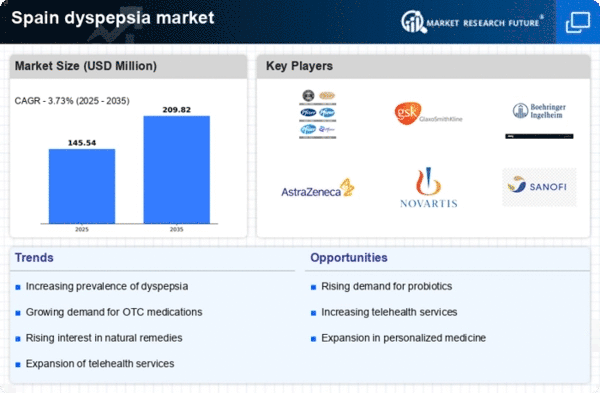

Growing Prevalence of Dyspepsia

The increasing prevalence of dyspepsia in Spain is a notable driver for the dyspepsia market. Recent studies indicate that approximately 25% of the Spanish population experiences dyspeptic symptoms at some point in their lives. This high incidence rate is likely to stimulate demand for various treatment options, including over-the-counter medications and prescription therapies. As healthcare providers become more aware of the condition, they may recommend more frequent screenings and treatments, further propelling market growth. The dyspepsia market in Spain is expected to expand as more individuals seek relief from symptoms such as bloating, nausea, and abdominal pain, which are common complaints among the affected population.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are significantly impacting the dyspepsia market in Spain. The development of new medications, including proton pump inhibitors and H2-receptor antagonists, has enhanced treatment options for patients suffering from dyspepsia. Recent data suggests that the market for these medications is projected to grow by approximately 15% annually, driven by ongoing clinical trials and research initiatives. Furthermore, the introduction of combination therapies may provide more effective solutions for patients, thereby increasing the overall market size. As pharmaceutical companies invest in research and development, the dyspepsia market is likely to benefit from a wider array of therapeutic options, catering to diverse patient needs.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in Spain is shaping the dyspepsia market. As public health campaigns promote awareness of gastrointestinal disorders, individuals are becoming more proactive in seeking medical advice for dyspeptic symptoms. This shift towards prevention is likely to result in earlier diagnosis and treatment, which may reduce the long-term burden of the condition. Additionally, healthcare providers are increasingly recommending lifestyle modifications and dietary changes as part of a comprehensive approach to managing dyspepsia. This trend could lead to a more informed patient population, ultimately driving growth in the dyspepsia market as individuals seek both preventive and therapeutic solutions.

Technological Innovations in Diagnostics

Technological advancements in diagnostic tools are transforming the dyspepsia market in Spain. The introduction of non-invasive testing methods, such as breath tests and advanced imaging techniques, is enhancing the accuracy of dyspepsia diagnoses. These innovations are likely to improve patient outcomes by facilitating timely and effective treatment. As healthcare providers adopt these technologies, the market may experience increased demand for diagnostic services. Furthermore, the integration of digital health solutions, such as mobile applications for symptom tracking, could empower patients to manage their condition more effectively. This evolution in diagnostics is expected to play a pivotal role in the growth of the dyspepsia market.