Growing Prevalence of Chronic Diseases

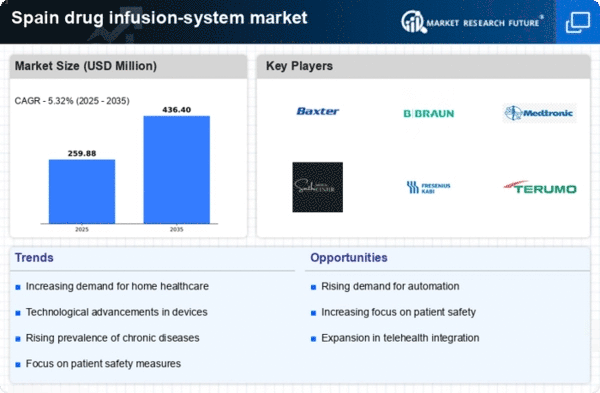

The drug infusion-system market in Spain is significantly influenced by the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders. As these conditions become more common, the need for effective drug delivery systems intensifies. Reports suggest that chronic diseases account for nearly 70% of all deaths in Spain, highlighting the urgent need for reliable treatment options. This scenario creates a substantial market opportunity for drug infusion systems, as they are essential for administering long-term therapies. Furthermore, advancements in infusion technology, such as smart pumps and automated systems, are likely to enhance treatment efficacy and patient compliance. Consequently, the growing burden of chronic diseases is expected to drive the demand for drug infusion systems in Spain, shaping the market landscape.

Rising Demand for Home Healthcare Solutions

The drug infusion-system market in Spain is experiencing a notable increase in demand for home healthcare solutions. This trend is driven by an aging population and a growing preference for at-home treatments. As more patients seek to manage chronic conditions from the comfort of their homes, the need for efficient and user-friendly drug infusion systems becomes paramount. According to recent estimates, the home healthcare market is projected to grow at a CAGR of approximately 8% over the next five years. This shift not only enhances patient comfort but also reduces hospital readmission rates, thereby alleviating pressure on healthcare facilities. Consequently, manufacturers are focusing on developing portable and easy-to-use infusion devices tailored for home use, which is likely to propel the drug infusion-system market in Spain further.

Technological Innovations in Infusion Devices

Technological innovations are playing a crucial role in shaping the drug infusion-system market in Spain. The introduction of smart infusion pumps, which offer features like dose error reduction systems and real-time monitoring, is transforming patient care. These advancements not only improve the accuracy of drug delivery but also enhance patient safety, which is a primary concern in healthcare settings. The market for smart infusion devices is projected to grow at a CAGR of around 10% over the next few years. Additionally, the integration of telehealth capabilities into infusion systems allows for remote monitoring and management, further expanding their utility. As healthcare providers increasingly adopt these advanced technologies, the drug infusion-system market is likely to witness substantial growth.

Emphasis on Cost-Effective Healthcare Solutions

In Spain, there is a growing emphasis on cost-effective healthcare solutions, which is influencing the drug infusion-system market. Healthcare providers are under pressure to reduce costs while maintaining high-quality patient care. This has led to an increased focus on the development of affordable drug infusion systems that do not compromise on quality or safety. Manufacturers are exploring innovative materials and production techniques to lower costs, making these systems more accessible to a broader range of healthcare facilities. Furthermore, the Spanish government is promoting initiatives aimed at optimizing healthcare spending, which may further drive the demand for cost-effective infusion solutions. As a result, the drug infusion-system market is likely to evolve, with a greater emphasis on affordability and efficiency.

Increased Investment in Healthcare Infrastructure

Spain's government is significantly investing in healthcare infrastructure, which is likely to bolster the drug infusion-system market. Recent initiatives aim to modernize hospitals and healthcare facilities, ensuring they are equipped with the latest medical technologies. This investment is expected to enhance the availability and accessibility of advanced drug infusion systems across the country. For instance, the Spanish Ministry of Health has allocated approximately €1 billion for healthcare upgrades in 2025 alone. Such financial commitments indicate a strong focus on improving patient care and outcomes, which may lead to increased adoption of sophisticated infusion systems. As healthcare facilities upgrade their equipment, the demand for innovative drug infusion solutions is anticipated to rise, thereby positively impacting the market.