Technological Innovations

Technological advancements play a pivotal role in shaping the direct methanol-fuel-cell market. Recent innovations in fuel cell design and materials have improved efficiency and reduced costs, making these systems more accessible to consumers and businesses. For example, the development of new catalysts has enhanced the performance of direct methanol-fuel-cells, allowing for higher energy outputs and longer operational lifespans. In Spain, research institutions and universities are actively collaborating with industry players to drive these innovations forward. The market is expected to benefit from ongoing research initiatives, which could lead to breakthroughs that further enhance the viability of direct methanol-fuel-cells in various applications, including portable electronics and electric vehicles. As technology continues to evolve, the market's potential for growth appears promising.

Rising Environmental Concerns

The increasing awareness of environmental issues in Spain is driving the direct methanol-fuel-cell market. As citizens and businesses alike become more conscious of their carbon footprints, there is a growing demand for cleaner energy solutions. The direct methanol-fuel-cell technology offers a promising alternative to traditional fossil fuels, as it emits significantly lower levels of greenhouse gases. In Spain, the government has set ambitious targets to reduce carbon emissions by 55% by 2030, which aligns with the market's potential for growth. This regulatory framework encourages investments in sustainable technologies, thereby enhancing the adoption of direct methanol-fuel-cell systems across various sectors, including transportation and stationary power generation. The market is projected to expand as more stakeholders recognize the benefits of integrating these fuel cells into their operations.

Supportive Regulatory Framework

Spain's regulatory environment is increasingly favorable for the direct methanol-fuel-cell market. The government has implemented various policies aimed at promoting renewable energy sources and reducing reliance on fossil fuels. For instance, the Spanish National Energy and Climate Plan outlines specific measures to support the development of alternative energy technologies, including fuel cells. This regulatory support is crucial for attracting investments and fostering innovation within the industry. Furthermore, the European Union's Green Deal aims to mobilize €1 trillion in investments for sustainable projects, which could significantly benefit the direct methanol-fuel-cell market. As regulations evolve to favor cleaner technologies, companies are likely to invest more in research and development, leading to enhanced product offerings and market growth.

Increased Investment in Renewable Energy

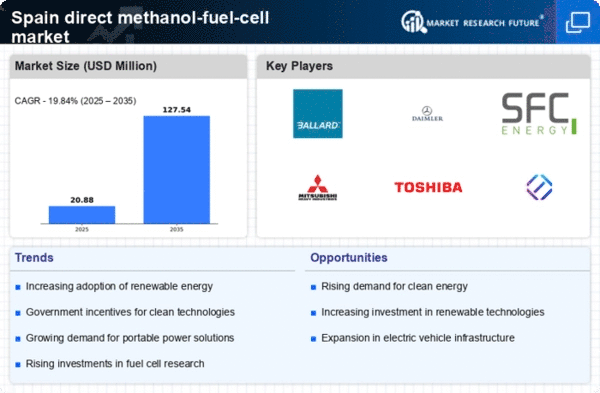

Investment in renewable energy sources is on the rise in Spain, which is positively impacting the direct methanol-fuel-cell market. The Spanish government has committed to increasing the share of renewables in its energy mix to 74% by 2030, creating a conducive environment for the growth of alternative energy technologies. This influx of capital is likely to enhance research and development efforts, leading to improved efficiency and cost-effectiveness of direct methanol-fuel-cells. Additionally, private sector investments are also increasing, as companies recognize the potential for profitability in the renewable energy sector. The direct methanol-fuel-cell market stands to benefit from this trend, as more resources are allocated to developing and deploying these technologies across various industries, including transportation and stationary power generation.

Growing Demand for Portable Power Solutions

The increasing need for portable power solutions in Spain is significantly influencing the direct methanol-fuel-cell market. As the demand for mobile devices and electric vehicles rises, there is a corresponding need for efficient and reliable power sources. Direct methanol-fuel-cells offer a lightweight and compact alternative to traditional batteries, making them particularly appealing for applications in consumer electronics and transportation. The market for portable power solutions is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust opportunity for direct methanol-fuel-cell technologies. This trend is further supported by the Spanish government's push for sustainable energy solutions, which encourages the adoption of innovative power sources that align with environmental goals.