Rising Aesthetic Dentistry Trends

The increasing popularity of aesthetic dentistry is driving demand within the dental radiology-imaging-devices market. In Spain, patients are becoming more conscious of their dental aesthetics, leading to a higher demand for cosmetic procedures that often require precise imaging for effective treatment planning. This trend is expected to contribute to a market growth rate of around 8% as dental professionals invest in advanced imaging technologies to meet patient expectations. The ability to provide detailed imaging for procedures such as veneers, implants, and orthodontics is becoming essential, thereby propelling the adoption of sophisticated imaging devices in dental practices across the country.

Growing Investment in Dental Infrastructure

Investment in dental infrastructure is a key driver for the dental radiology-imaging-devices market. In Spain, both public and private sectors are increasing their funding for dental facilities, which includes the acquisition of advanced imaging technologies. This trend is likely to enhance the availability of high-quality dental care and improve diagnostic capabilities. Analysts predict that the market could see a growth of approximately 9% as new dental clinics and practices emerge, equipped with the latest imaging devices. This investment not only supports the modernization of dental practices but also aligns with the broader goal of improving oral health outcomes for the population.

Increasing Demand for Preventive Dental Care

The growing emphasis on preventive dental care is significantly influencing the dental radiology-imaging-devices market. In Spain, there is a notable shift towards early detection of dental issues, which necessitates the use of advanced imaging technologies. This trend is supported by a rise in public awareness regarding oral health, leading to an increase in routine dental check-ups. As a result, the demand for imaging devices that facilitate early diagnosis is expected to grow, with market analysts estimating a growth rate of around 12% over the next few years. This shift towards preventive care not only enhances patient outcomes but also drives the adoption of sophisticated imaging solutions in dental practices.

Technological Advancements in Imaging Devices

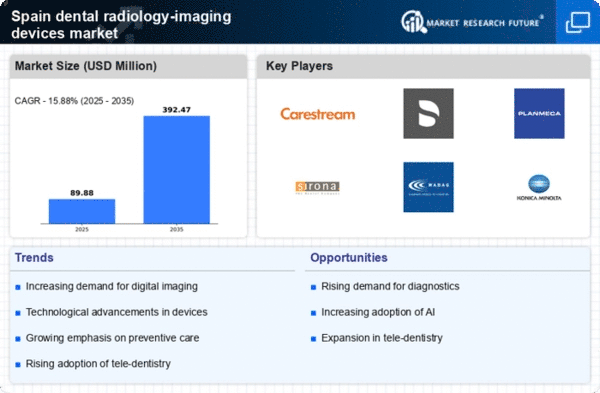

The dental radiology-imaging-devices market is experiencing a surge in technological advancements, particularly in digital imaging technologies. Innovations such as cone beam computed tomography (CBCT) and 3D imaging are enhancing diagnostic accuracy and treatment planning. In Spain, the adoption of these advanced imaging devices is projected to increase by approximately 15% annually, driven by the demand for precise imaging solutions. Furthermore, the integration of artificial intelligence in imaging devices is expected to streamline workflows and improve patient outcomes. As dental professionals seek to enhance their diagnostic capabilities, the market for these advanced imaging devices is likely to expand, reflecting a broader trend towards technology-driven healthcare solutions.

Regulatory Support for Advanced Imaging Technologies

Regulatory bodies in Spain are increasingly supporting the adoption of advanced imaging technologies within the dental radiology-imaging-devices market. Initiatives aimed at streamlining the approval process for new imaging devices are likely to encourage innovation and investment in this sector. The Spanish government has introduced policies that promote the use of state-of-the-art imaging technologies, which could lead to a market growth of approximately 10% in the coming years. This regulatory support is crucial for manufacturers and dental practitioners, as it fosters an environment conducive to the development and implementation of cutting-edge imaging solutions, ultimately benefiting patient care.