Rising Geriatric Population

The increasing geriatric population in Spain is a crucial driver for the dental biomaterials market. As the population ages, there is a corresponding rise in dental issues such as tooth decay, periodontal disease, and the need for restorative procedures. This demographic shift necessitates the use of durable and biocompatible materials that can withstand the unique challenges posed by older patients. Reports indicate that by 2030, nearly 25% of the Spanish population will be over 65 years old, creating a substantial demand for dental solutions tailored to this age group. Consequently, dental practitioners are likely to invest in high-quality biomaterials that ensure longevity and patient satisfaction. This trend underscores the importance of adapting dental practices to meet the needs of an aging population, thereby propelling the growth of the dental biomaterials market.

Increasing Oral Health Awareness

The growing awareness of oral health among the Spanish population is a pivotal driver for the dental biomaterials market. As individuals become more informed about the importance of dental hygiene and its impact on overall health, the demand for advanced dental solutions rises. This trend is reflected in the increasing number of dental visits, which has reportedly risen by 15% in recent years. Consequently, dental professionals are more inclined to utilize innovative biomaterials that enhance treatment outcomes. The emphasis on preventive care and aesthetic improvements further propels the market, as patients seek high-quality materials for procedures such as fillings, crowns, and implants. This heightened focus on oral health is likely to sustain the growth trajectory of the dental biomaterials market in Spain, as both practitioners and patients prioritize effective and durable solutions.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and quality are playing a significant role in shaping the dental biomaterials market. In Spain, various programs have been introduced to enhance dental care services, particularly in underserved areas. These initiatives often include funding for dental clinics to adopt advanced technologies and materials, thereby increasing the availability of high-quality dental care. For instance, recent funding allocations have focused on promoting preventive dental care and education, which indirectly boosts the demand for innovative biomaterials. As public health policies evolve to prioritize oral health, the dental biomaterials market is likely to benefit from increased investments and support, fostering an environment conducive to growth and innovation.

Technological Innovations in Dental Practices

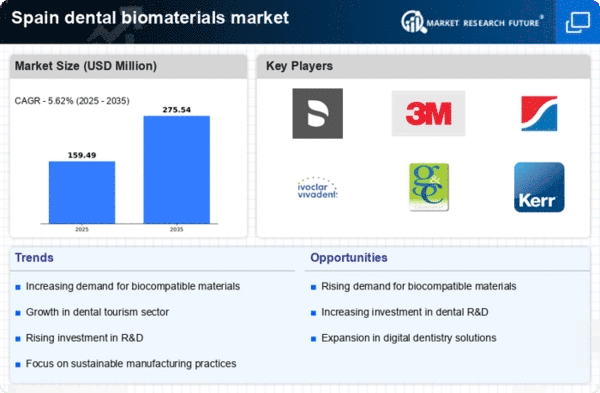

Technological advancements in dental practices are significantly influencing the dental biomaterials market. Innovations such as 3D printing, digital impressions, and computer-aided design (CAD) are revolutionizing the way dental materials are developed and utilized. These technologies enable the creation of customized solutions that cater to individual patient needs, thereby enhancing treatment efficacy. For instance, the integration of CAD/CAM systems has streamlined the production of dental restorations, reducing turnaround times and improving precision. As a result, dental professionals in Spain are increasingly adopting these technologies, which in turn drives the demand for advanced biomaterials. The market is expected to witness a compound annual growth rate (CAGR) of approximately 8% over the next five years, largely attributed to these technological innovations that enhance the quality and efficiency of dental care.

Consumer Preference for Biocompatible Materials

There is a notable shift in consumer preference towards biocompatible materials in the dental biomaterials market. Patients are increasingly aware of the potential health implications associated with dental materials, leading to a demand for safer, non-toxic options. This trend is particularly evident in the rising popularity of materials such as zirconia and bioglass, which are known for their compatibility with human tissue. As dental professionals in Spain respond to these preferences, they are more likely to incorporate biocompatible materials into their practices. This shift not only enhances patient safety but also aligns with broader trends in healthcare that emphasize sustainability and minimal environmental impact. The growing inclination towards biocompatibility is expected to drive innovation and development within the dental biomaterials market, as manufacturers strive to meet evolving consumer expectations.