Growth of Data-Driven Decision Making

In Spain, the shift towards data-driven decision-making is influencing various sectors, including telecommunications and IT. Organizations are increasingly leveraging data analytics to optimize operations and enhance customer experiences. The deep packet-inspection market plays a crucial role in this transformation by providing insights into network performance and user behavior. By analyzing packet data, companies can identify trends, improve service delivery, and tailor offerings to meet customer needs. This trend is particularly relevant in the telecommunications sector, where service providers are expected to invest heavily in deep packet-inspection technologies to gain a competitive edge. As data becomes a pivotal asset, the demand for deep packet-inspection solutions is likely to rise, further propelling market growth.

Advancements in Network Infrastructure

The ongoing advancements in network infrastructure in Spain are creating a conducive environment for the growth of the deep packet-inspection market. The rollout of 5G technology and the expansion of fiber-optic networks are enhancing data transmission speeds and increasing the volume of network traffic. As a result, organizations are compelled to adopt deep packet-inspection solutions to manage and analyze this influx of data effectively. The ability to inspect packets in real-time allows businesses to optimize network performance and ensure quality of service. This trend is expected to drive investments in deep packet-inspection technologies, as companies aim to leverage the benefits of advanced network infrastructure while maintaining security and compliance.

Emergence of IoT and Connected Devices

The proliferation of Internet of Things (IoT) devices in Spain is reshaping the landscape of the deep packet-inspection market. As more devices become interconnected, the volume of data generated is increasing exponentially, necessitating advanced monitoring solutions. Deep packet-inspection technologies are essential for managing the complexities associated with IoT networks, enabling organizations to analyze traffic patterns and detect anomalies. This trend is particularly relevant in sectors such as healthcare and smart cities, where the integration of IoT devices is becoming commonplace. The deep packet-inspection market is likely to see substantial growth as organizations seek to harness the potential of IoT while ensuring the security and integrity of their networks.

Rising Demand for Network Security Solutions

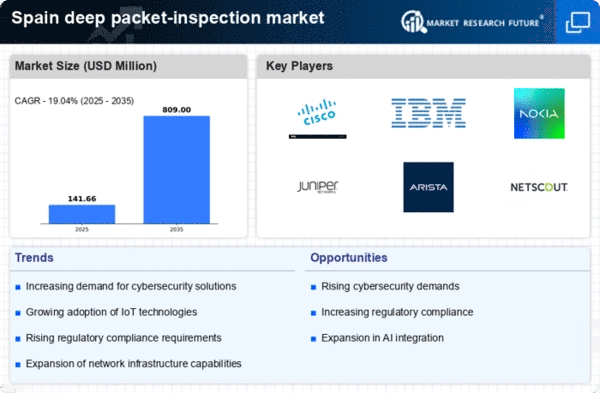

The increasing frequency of cyber threats in Spain has led to a heightened demand for robust network security solutions. Organizations are increasingly recognizing the necessity of deep packet-inspection market technologies to safeguard sensitive data and maintain operational integrity. In 2025, the cybersecurity market in Spain is projected to reach approximately €3 billion, indicating a strong inclination towards investing in advanced security measures. This trend is likely to drive the adoption of deep packet-inspection technologies, as they provide comprehensive visibility into network traffic, enabling organizations to detect and mitigate potential threats effectively. As businesses strive to protect their digital assets, the deep packet-inspection market is expected to experience significant growth, fueled by the urgent need for enhanced security protocols.

Regulatory Landscape and Compliance Requirements

The regulatory environment in Spain is evolving, with increasing emphasis on data protection and privacy laws. The implementation of the General Data Protection Regulation (GDPR) has heightened the need for organizations to ensure compliance with stringent data handling practices. This regulatory landscape is driving the adoption of deep packet-inspection market technologies, as they enable organizations to monitor and control data flows effectively. Companies are investing in these solutions to avoid potential fines and reputational damage associated with non-compliance. The deep packet-inspection market is likely to benefit from this trend, as organizations seek to implement robust monitoring systems that align with regulatory requirements, ensuring the protection of sensitive information.