Rising Awareness of Eye Health

The increasing awareness of eye health among the Spanish population appears to be a significant driver for the corneal cross-linking-devices market. Educational campaigns and initiatives by healthcare providers have led to a heightened understanding of corneal diseases and the benefits of early intervention. This awareness is likely to result in more patients seeking treatment options, thereby expanding the market. In Spain, the prevalence of keratoconus, a condition that can be treated with corneal cross-linking, is estimated to affect approximately 1 in 2,000 individuals. As more people become informed about this condition and its treatment, the demand for corneal cross-linking devices is expected to rise, potentially increasing market revenues substantially.

Supportive Healthcare Policies

Supportive healthcare policies in Spain are contributing to the growth of the corneal cross-linking-devices market. The Spanish government has been actively promoting eye care initiatives, which include funding for advanced treatments and devices. This support is likely to enhance accessibility to corneal cross-linking procedures, encouraging more clinics to offer these services. Additionally, reimbursement policies for corneal cross-linking treatments are becoming more favorable, which may alleviate financial burdens for patients. As a result, the market could see an increase in the number of procedures performed, potentially leading to a market valuation exceeding €50 million by 2027.

Aging Population and Increased Demand

The aging population in Spain is another critical driver for the corneal cross-linking-devices market. As individuals age, the incidence of corneal diseases tends to rise, leading to a greater need for effective treatment options. The demographic shift towards an older population is likely to result in a higher prevalence of conditions such as keratoconus and other corneal ectasias. This trend suggests that the demand for corneal cross-linking devices will increase as more elderly patients seek treatment. Projections indicate that by 2030, the number of individuals aged 65 and older in Spain will reach approximately 9 million, further emphasizing the potential growth of the market in response to this demographic change.

Technological Innovations in Treatment

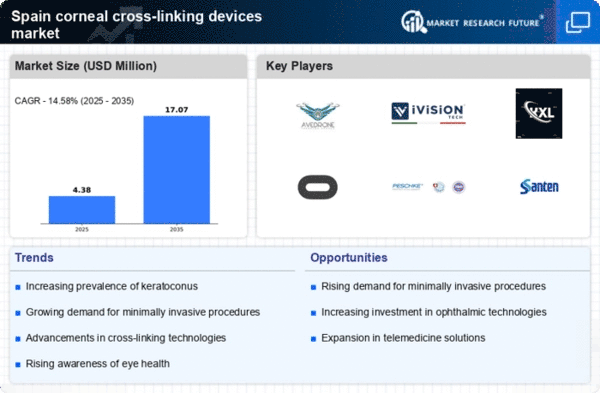

Technological advancements in the field of ophthalmology are driving the corneal cross-linking-devices market in Spain. Innovations such as improved UV light delivery systems and enhanced riboflavin solutions are making procedures more effective and safer. These advancements not only improve patient outcomes but also increase the efficiency of the treatment process. The introduction of new devices that offer better precision and reduced recovery times is likely to attract more healthcare facilities to adopt corneal cross-linking treatments. As a result, the market is projected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 8% over the next few years, reflecting the positive impact of these technological innovations.

Collaboration Between Industry and Academia

Collaboration between industry and academic institutions in Spain is fostering innovation in the corneal cross-linking-devices market. Research partnerships are leading to the development of new technologies and treatment protocols that enhance the effectiveness of corneal cross-linking. These collaborations often result in clinical trials that validate the efficacy of new devices, thereby increasing their acceptance in the medical community. As more innovative solutions emerge from these partnerships, the market is likely to expand, with an anticipated increase in investment in research and development. This synergy between academia and industry could potentially lead to breakthroughs that redefine treatment standards in the corneal cross-linking-devices market.