Integration of Advanced Technologies

The integration of advanced technologies into the clinical laboratory-test market is transforming the landscape of diagnostic testing in Spain. Innovations such as artificial intelligence, machine learning, and automation are streamlining laboratory processes, improving accuracy, and reducing turnaround times. For instance, the implementation of automated systems can enhance efficiency by up to 30%, allowing laboratories to handle a higher volume of tests. Furthermore, the adoption of telemedicine and digital health solutions is facilitating remote testing and consultations, which is particularly relevant in the current healthcare environment. This technological evolution not only improves patient outcomes but also positions laboratories to better meet the demands of healthcare providers and patients alike, thereby driving growth in the clinical laboratory-test market.

Rising Demand for Diagnostic Testing

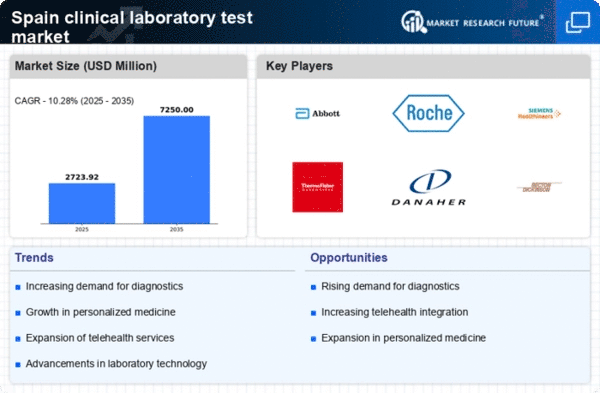

The clinical laboratory-test market in Spain experiences a notable increase in demand for diagnostic testing. This trend is driven by a growing awareness of health issues among the population, leading to more individuals seeking preventive and routine health check-ups. According to recent data, the market is projected to grow at a CAGR of approximately 6.5% over the next five years. This growth is indicative of a shift in consumer behavior, where patients are more proactive about their health. Additionally, the increasing prevalence of chronic diseases necessitates regular testing, further propelling the demand for laboratory services. As a result, laboratories are expanding their testing capabilities to meet this rising demand, which is likely to enhance the overall clinical laboratory-test market in Spain.

Growing Focus on Personalized Medicine

The clinical laboratory-test market is witnessing a growing focus on personalized medicine, which tailors medical treatment to individual characteristics. This trend is particularly relevant in Spain, where advancements in genomics and biotechnology are paving the way for more targeted therapies. As healthcare providers increasingly rely on genetic testing to inform treatment decisions, the demand for specialized laboratory tests is likely to rise. Reports suggest that the market for genetic testing alone could reach €1 billion by 2027, reflecting the potential for growth in this segment. This shift towards personalized medicine not only enhances patient care but also drives innovation within the clinical laboratory-test market.

Aging Population and Chronic Disease Prevalence

The aging population in Spain is a significant driver of the clinical laboratory-test market. As the demographic landscape shifts, there is a corresponding increase in the prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer. This demographic trend necessitates regular monitoring and testing, thereby boosting the demand for laboratory services. Current statistics indicate that approximately 25% of the Spanish population is over 65 years old, a figure that is expected to rise. Consequently, laboratories are adapting their services to cater to this demographic, which is likely to sustain growth in the clinical laboratory-test market for years to come.

Increased Investment in Healthcare Infrastructure

Spain's clinical laboratory-test market benefits from increased investment in healthcare infrastructure. The government and private sector are channeling funds into modernizing laboratory facilities and expanding testing capabilities. Recent reports indicate that healthcare expenditure in Spain is expected to rise by approximately 4% annually, with a significant portion allocated to laboratory services. This investment is crucial for enhancing the quality of diagnostic testing and ensuring that laboratories can keep pace with the growing demand for services. Improved infrastructure not only supports the clinical laboratory-test market but also fosters innovation and research, ultimately leading to better healthcare outcomes for the population.