Advancements in Biotechnology Research

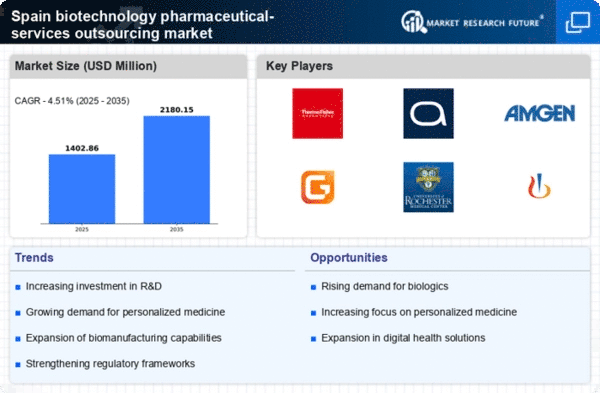

Technological advancements in biotechnology are significantly influencing the biotechnology pharmaceutical-services-outsources market. Innovations in gene editing, synthetic biology, and bioinformatics are enabling researchers to develop more effective therapies and streamline drug discovery processes. In Spain, the biotechnology sector has seen an increase in funding, with investments reaching approximately €1 billion in 2025. This influx of capital is likely to enhance collaboration between biotech firms and outsourcing service providers, fostering a more integrated approach to research and development. As a result, the biotechnology pharmaceutical-services-outsources market is poised for growth, driven by the need for specialized services that can support complex biotechnological projects.

Increasing Demand for Biopharmaceuticals

The biotechnology pharmaceutical-services-outsources market is experiencing a notable surge in demand for biopharmaceuticals, driven by the rising prevalence of chronic diseases and the aging population in Spain. This demand is reflected in the market's growth trajectory, with biopharmaceuticals projected to account for over 50% of the total pharmaceutical market by 2025. The increasing focus on innovative therapies, particularly in oncology and autoimmune diseases, is propelling investments in research and development. Consequently, biotechnology firms are seeking outsourcing services to enhance their operational efficiency and expedite drug development processes. This trend indicates a robust opportunity for service providers within the biotechnology pharmaceutical-services-outsources market to cater to the evolving needs of biopharmaceutical companies.

Growing Emphasis on Regulatory Compliance

The biotechnology pharmaceutical-services-outsources market is increasingly shaped by the need for stringent regulatory compliance. In Spain, regulatory bodies are enhancing their frameworks to ensure the safety and efficacy of biopharmaceutical products. This shift necessitates that biotechnology companies invest in outsourcing services that specialize in regulatory affairs, clinical trials, and quality assurance. As a result, the market for these services is expected to expand, with a projected growth rate of around 8% annually through 2025. The emphasis on compliance not only mitigates risks but also enhances the credibility of biopharmaceutical products, thereby driving demand for outsourcing solutions within the biotechnology pharmaceutical-services-outsources market.

Rise of Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are becoming increasingly prevalent within the biotechnology pharmaceutical-services-outsources market. Companies are recognizing the value of leveraging external expertise to accelerate drug development and reduce costs. In Spain, numerous biotech firms are forming alliances with contract research organizations (CROs) and contract manufacturing organizations (CMOs) to enhance their capabilities. This trend is indicative of a broader shift towards a collaborative ecosystem, where shared resources and knowledge can lead to more efficient outcomes. The biotechnology pharmaceutical-services-outsources market is likely to benefit from this trend, as partnerships can facilitate access to advanced technologies and specialized services that are essential for successful product development.

Focus on Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are critical drivers in the biotechnology pharmaceutical-services-outsources market. As competition intensifies, biotechnology companies in Spain are increasingly seeking ways to reduce operational costs while maintaining high-quality standards. Outsourcing non-core functions, such as clinical trials and manufacturing, allows these companies to focus on their core competencies and accelerate time-to-market for new products. The market for outsourcing services is projected to grow by approximately 10% annually, reflecting the increasing reliance on external providers to achieve cost savings. This trend underscores the importance of strategic outsourcing in enhancing the overall competitiveness of firms within the biotechnology pharmaceutical-services-outsources market.