Rising Industrial Waste Generation

The bioremediation market is significantly influenced by the rising generation of industrial waste in Spain. As industries expand, the volume of hazardous waste produced increases, necessitating effective waste management solutions. Bioremediation offers a sustainable approach to treating contaminated sites, making it an attractive option for companies facing disposal challenges. In 2024, it was reported that industrial waste in Spain reached approximately 30 million tons, highlighting the urgent need for remediation strategies. This growing waste generation is likely to drive demand for bioremediation services, as businesses seek to address contamination issues while minimizing environmental harm. Consequently, the market is expected to witness a surge in investments and innovations in bioremediation technologies.

Increasing Environmental Regulations

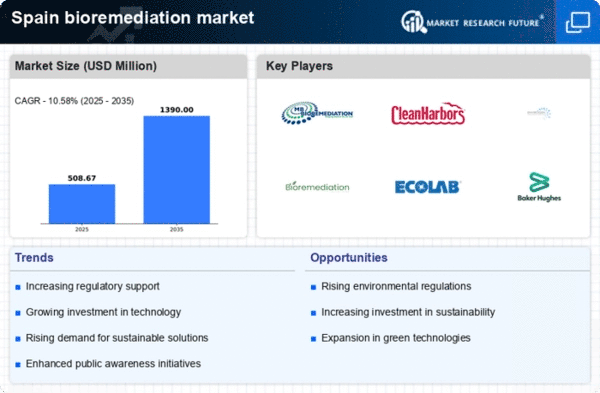

The bioremediation market in Spain is experiencing growth due to the increasing stringency of environmental regulations. The Spanish government has implemented various policies aimed at reducing pollution and promoting sustainable practices. This regulatory framework encourages industries to adopt bioremediation techniques to comply with environmental standards. For instance, the European Union's directives on waste management and soil protection have prompted Spanish companies to invest in bioremediation solutions. As a result, the market is projected to expand, with an estimated growth rate of 8% annually over the next five years. This trend indicates a robust demand for bioremediation services, as industries seek to mitigate their environmental impact and adhere to legal requirements.

Advancements in Bioremediation Technologies

Technological advancements play a crucial role in shaping the bioremediation market in Spain. Innovations in microbial treatments, biostimulation, and phytoremediation techniques are enhancing the efficiency and effectiveness of bioremediation processes. These advancements enable faster and more cost-effective remediation of contaminated sites, appealing to both public and private sectors. For instance, the development of genetically engineered microorganisms has shown promise in degrading complex pollutants. As these technologies become more accessible, the market is likely to see increased adoption, with a projected growth rate of 10% over the next few years. This trend suggests that the bioremediation market will continue to evolve, driven by the need for efficient environmental solutions.

Growing Investment in Sustainable Practices

Investment in sustainable practices is becoming a key driver for the bioremediation market in Spain. Companies are increasingly recognizing the importance of environmental stewardship and are allocating resources towards sustainable remediation methods. This shift is partly influenced by consumer demand for environmentally friendly products and services. In 2025, it is estimated that investments in sustainable technologies, including bioremediation, will reach €500 million in Spain. This influx of capital is likely to foster innovation and expand the availability of bioremediation services. As businesses strive to enhance their sustainability profiles, the bioremediation market is expected to benefit from this growing trend, leading to enhanced market dynamics and opportunities.

Public Health Concerns and Community Engagement

Public health concerns related to environmental contamination are driving interest in the bioremediation market in Spain. Communities affected by pollution are increasingly advocating for cleaner environments, prompting local governments and industries to take action. This heightened awareness has led to greater community engagement in remediation projects, often resulting in collaborative efforts between stakeholders. In 2025, it is projected that community-led initiatives will account for approximately 15% of bioremediation projects in Spain. This trend indicates a shift towards more inclusive approaches to environmental management, where public health considerations are prioritized. As a result, the bioremediation market is likely to see increased demand for services that address both environmental and public health needs.