Rising Operational Costs

In Spain, the asset performance-management market is significantly impacted by the rising operational costs faced by various industries. Companies are increasingly seeking ways to optimize their asset utilization and reduce maintenance expenses. According to recent data, operational costs in sectors such as manufacturing and energy have surged by approximately 15% over the past year. This trend compels organizations to adopt asset performance-management solutions that can provide insights into asset health and performance. By leveraging these technologies, businesses can identify inefficiencies and implement cost-saving measures, thereby driving demand for asset performance-management solutions in the market.

Regulatory Compliance Pressure

The asset performance-management in Spain is increasingly influenced by stringent regulatory frameworks. The government has implemented various regulations aimed at enhancing operational efficiency and sustainability across industries. Compliance with these regulations often necessitates the adoption of advanced asset performance-management solutions. Companies that fail to comply may face substantial fines, which could reach up to €500,000. This regulatory pressure drives organizations to invest in asset performance-management technologies to ensure adherence and avoid penalties. As a result, the market is likely to experience growth as businesses seek to align their operations with legal requirements, thereby enhancing their asset management capabilities.

Focus on Digital Transformation

Digital transformation initiatives are reshaping the asset performance-management in Spain. Organizations are increasingly recognizing the need to modernize their asset management practices to remain competitive. This shift is evidenced by a reported 25% increase in investments in digital technologies across various sectors. Companies are adopting asset performance-management solutions that integrate advanced analytics and machine learning to enhance decision-making processes. This focus on digital transformation not only improves asset reliability but also drives innovation within organizations. As a result, the asset performance-management market is poised for growth as businesses seek to leverage digital tools to optimize their asset management strategies.

Integration of IoT Technologies

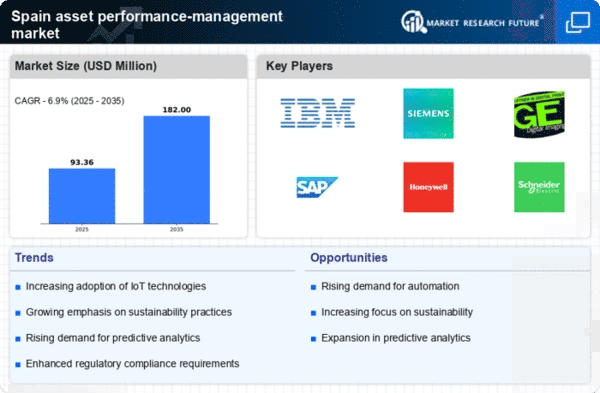

The integration of Internet of Things (IoT) technologies is transforming the asset performance-management in Spain. IoT devices enable real-time monitoring and data collection from assets, facilitating proactive maintenance and performance optimization. As of November 2025, it is estimated that over 30% of companies in Spain have adopted IoT solutions for asset management. This trend indicates a growing recognition of the benefits of data-driven insights in enhancing asset performance. Consequently, the asset performance-management market is likely to expand as organizations increasingly invest in IoT-enabled solutions to improve operational efficiency and reduce downtime.

Increased Demand for Predictive Maintenance

The asset performance-management in Spain is witnessing a surge in demand for predictive maintenance solutions. Companies are increasingly aware of the potential cost savings and efficiency gains associated with predictive maintenance strategies. Recent studies indicate that predictive maintenance can reduce maintenance costs by up to 30% and extend asset lifespan by 20%. This growing awareness is prompting organizations to invest in asset performance-management technologies that facilitate predictive analytics. As businesses strive to minimize unplanned downtime and enhance asset reliability, the asset performance-management market is likely to experience robust growth driven by this demand.