Patient Advocacy and Support Groups

The presence of patient advocacy and support groups is playing a pivotal role in shaping the arachnoiditis market in Spain. These organizations are dedicated to raising awareness about arachnoiditis, providing resources for patients, and advocating for better treatment options. Their efforts contribute to increased visibility of the condition, which may lead to more individuals seeking diagnosis and treatment. Furthermore, these groups often collaborate with healthcare professionals and policymakers to influence research funding and healthcare policies. As patient advocacy continues to grow, it is likely to have a positive impact on the arachnoiditis market, fostering an environment conducive to improved patient care and treatment accessibility.

Advancements in Diagnostic Techniques

The evolution of diagnostic techniques is significantly impacting the arachnoiditis market in Spain. Enhanced imaging technologies, such as MRI and CT scans, have improved the accuracy of diagnosing arachnoiditis, allowing for earlier detection and intervention. This advancement is crucial, as timely diagnosis can lead to better management of the condition and improved patient quality of life. As diagnostic capabilities continue to evolve, healthcare professionals are likely to identify more cases, which may lead to an increase in treatment demand. Consequently, this trend is expected to stimulate growth in the arachnoiditis market, as more patients are diagnosed and seek appropriate therapies.

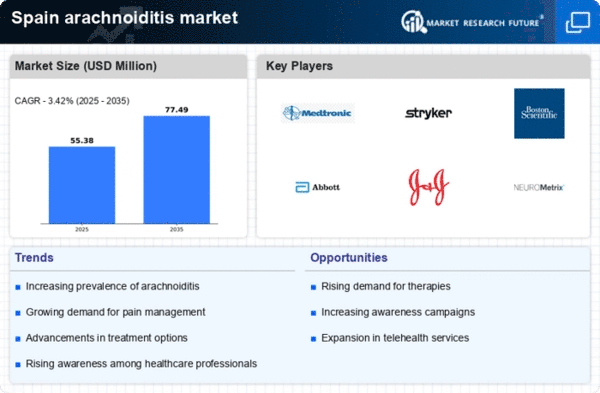

Increasing Incidence of Arachnoiditis

The arachnoiditis market in Spain is experiencing growth due to the rising incidence of arachnoiditis cases. Recent studies indicate that the prevalence of this condition is increasing, with estimates suggesting that approximately 1.5 to 2.5 cases per 100,000 individuals are diagnosed annually. This uptick in cases necessitates enhanced medical attention and treatment options, thereby driving demand within the arachnoiditis market. As healthcare providers become more aware of the condition, the need for specialized care and innovative therapies is likely to expand, further contributing to market growth. The increasing number of patients seeking treatment is expected to create opportunities for pharmaceutical companies and healthcare providers to develop targeted therapies and improve patient outcomes.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is emerging as a significant driver in the arachnoiditis market in Spain. The Spanish government and regulatory bodies are increasingly recognizing the need for expedited approval processes for new treatments targeting rare and complex conditions like arachnoiditis. This supportive regulatory environment encourages pharmaceutical companies to invest in the development of innovative therapies, which may lead to a broader range of treatment options for patients. As a result, the market is likely to witness an influx of new products and therapies, enhancing the overall treatment landscape for arachnoiditis. This trend not only benefits patients but also stimulates economic growth within the healthcare sector.

Growing Investment in Research and Development

Investment in research and development (R&D) is a key driver for the arachnoiditis market in Spain. Pharmaceutical companies are increasingly allocating resources to develop new treatment modalities and therapies for arachnoiditis. This focus on R&D is essential, as it may lead to the discovery of novel drugs and treatment protocols that can effectively address the complexities of the condition. In recent years, funding for clinical trials and studies has seen a notable increase, with estimates suggesting that R&D expenditures in the healthcare sector could reach €5 billion by 2026. This influx of investment is likely to enhance the therapeutic landscape for arachnoiditis, ultimately benefiting patients and healthcare providers alike.