Rising Awareness and Education on Thrombosis

There is a growing awareness regarding thrombosis and its associated risks among the Spanish population, which serves as a significant driver for the anticoagulation market. Educational campaigns led by healthcare organizations have increased public knowledge about the importance of anticoagulation therapy in preventing strokes and other complications. This heightened awareness is reflected in a 15% increase in patient consultations for anticoagulant therapy over the past year. As more individuals seek preventive measures, the demand for anticoagulants is likely to rise, thereby positively impacting the anticoagulation market.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving cardiovascular health significantly influence the anticoagulation market in Spain. Policies promoting early diagnosis and treatment of thromboembolic disorders are being implemented, which enhances patient access to anticoagulant therapies. The Spanish government has allocated substantial funding, estimated at €200 million annually, to support research and development in this field. Such initiatives not only improve healthcare outcomes but also stimulate market growth by encouraging pharmaceutical companies to innovate and introduce new anticoagulant products. Consequently, these policies create a favorable environment for the anticoagulation market to thrive.

Increasing Prevalence of Cardiovascular Diseases

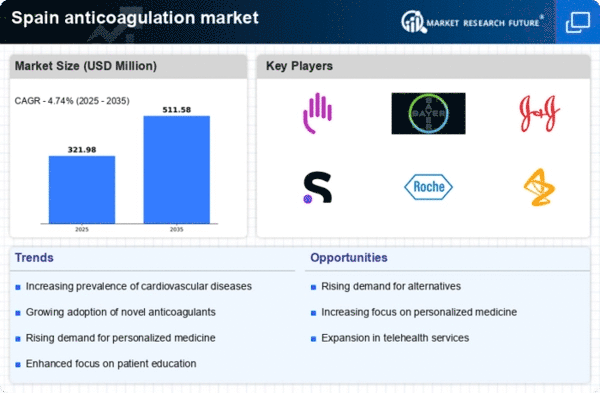

The rising incidence of cardiovascular diseases in Spain is a critical driver for the anticoagulation market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates effective anticoagulation therapies to manage conditions such as atrial fibrillation and venous thromboembolism. As the population ages, the demand for anticoagulants is expected to grow, with projections indicating a market expansion of around 5% annually. The increasing burden of these diseases compels healthcare providers to adopt advanced anticoagulation therapies, thereby propelling the anticoagulation market forward.

Technological Advancements in Drug Delivery Systems

Technological innovations in drug delivery systems are transforming the anticoagulation market in Spain. The development of novel delivery methods, such as subcutaneous and oral formulations, enhances patient compliance and treatment efficacy. Recent advancements have led to the introduction of user-friendly devices that allow for self-administration of anticoagulants, which is particularly beneficial for patients with chronic conditions. This shift towards more accessible treatment options is expected to drive market growth, with estimates suggesting a potential increase in market size by 10% over the next five years. Such advancements indicate a promising future for the anticoagulation market.

Aging Population and Increased Healthcare Expenditure

The demographic shift towards an aging population in Spain is a pivotal driver for the anticoagulation market. As individuals age, the prevalence of conditions requiring anticoagulation therapy, such as atrial fibrillation, escalates. Current projections indicate that by 2030, over 20% of the Spanish population will be over 65 years old, leading to increased healthcare expenditure on chronic disease management. This demographic trend compels healthcare systems to allocate more resources towards anticoagulant therapies, thereby fostering growth in the anticoagulation market. The financial commitment to managing age-related health issues is likely to enhance the market landscape.