Aging Population

The demographic shift towards an aging population in South Korea significantly influences the positron emission-tomography-devices market. By 2025, it is estimated that over 20% of the population will be aged 65 and above, leading to a higher incidence of age-related diseases. This demographic trend necessitates advanced diagnostic tools to effectively manage and treat conditions such as cancer and Alzheimer's disease. The demand for PET devices is likely to surge as healthcare providers seek to enhance diagnostic capabilities and improve patient outcomes. Additionally, the aging population may drive the need for more comprehensive healthcare services, further stimulating the positron emission-tomography-devices market. As the healthcare system adapts to cater to this demographic, investments in advanced imaging technologies will become increasingly critical.

Increasing Healthcare Expenditure

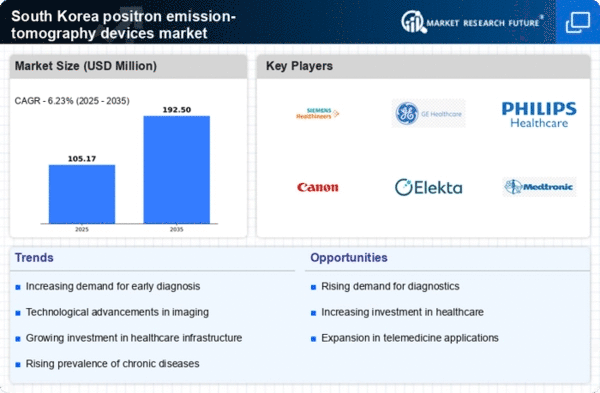

The rising healthcare expenditure in South Korea is a pivotal driver for the positron emission-tomography-devices market. As the government allocates more funds towards healthcare, the demand for advanced diagnostic tools, including PET devices, is likely to increase. In 2025, healthcare spending is projected to reach approximately $200 billion, reflecting a growth rate of around 5% annually. This financial commitment enables hospitals and clinics to invest in state-of-the-art imaging technologies, enhancing patient care and diagnostic accuracy. Furthermore, the increasing prevalence of diseases such as cancer and neurological disorders necessitates the adoption of advanced imaging techniques, thereby propelling the positron emission-tomography-devices market forward. The focus on improving healthcare infrastructure and technology adoption is expected to create a favorable environment for market growth.

Rising Awareness of Early Diagnosis

There is a growing awareness among the South Korean population regarding the importance of early diagnosis in disease management, which serves as a significant driver for the positron emission-tomography-devices market. Educational campaigns and healthcare initiatives have emphasized the benefits of early detection, particularly for cancers and other critical conditions. This heightened awareness is likely to lead to increased demand for advanced imaging technologies, including PET devices, as patients and healthcare providers prioritize early diagnostic methods. The market is expected to witness a surge in adoption rates, with projections indicating a potential growth of 10% in the next few years. As more individuals seek preventive healthcare measures, the positron emission-tomography-devices market is poised for substantial expansion.

Technological Innovations in Imaging

Technological innovations in imaging modalities are transforming the landscape of the positron emission-tomography-devices market. Advancements such as hybrid imaging systems, which combine PET with CT or MRI, are enhancing diagnostic accuracy and efficiency. These innovations are likely to attract healthcare facilities in South Korea to upgrade their imaging capabilities. The introduction of new software algorithms and improved detector technologies is also expected to enhance image quality and reduce scan times. As hospitals and diagnostic centers strive to provide superior patient care, the demand for cutting-edge PET devices is anticipated to rise. The ongoing research and development efforts in imaging technology may further propel the positron emission-tomography-devices market, fostering a competitive environment that encourages continuous improvement.

Government Initiatives for Healthcare Technology

Government initiatives aimed at promoting healthcare technology adoption are playing a crucial role in shaping the positron emission-tomography-devices market. Policies that encourage investment in advanced medical technologies, including PET devices, are likely to enhance market growth. The South Korean government has implemented various funding programs and incentives to support healthcare facilities in acquiring state-of-the-art imaging equipment. These initiatives are expected to facilitate the integration of advanced diagnostic tools into clinical practice, thereby improving patient outcomes. Furthermore, collaborations between the government and private sector in research and development may lead to innovative solutions in the positron emission-tomography-devices market. As these initiatives gain momentum, the market is poised for significant advancements and expansion.