South Korea Formic Acid Market Summary

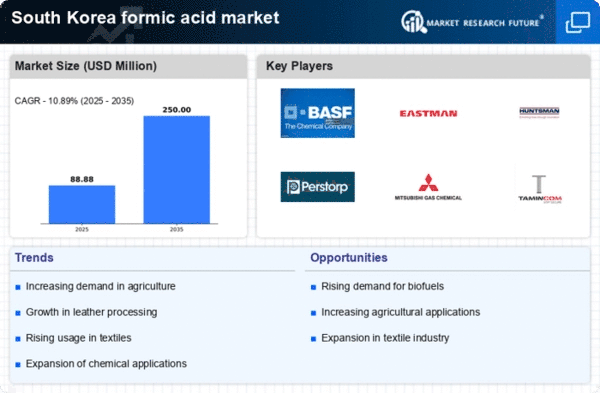

As per Market Research Future analysis, the Formic Acid market size was estimated at 80.15 $ Million in 2024. The formic acid market is projected to grow from 88.88 $ Million in 2025 to 250.0 $ Million by 2035, exhibiting a compound annual growth rate (CAGR) of 10.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The South Korea formic acid market is experiencing robust growth driven by agricultural and industrial demands.

- The agricultural sector is witnessing rising demand for formic acid, particularly in livestock feed applications.

- Sustainability initiatives are propelling the adoption of formic acid in various chemical manufacturing processes.

- The textile industry is emerging as a significant segment, with increasing utilization of formic acid for dyeing and finishing.

- Key market drivers include the expansion of chemical applications and regulatory support for organic farming, which are likely to enhance market growth.

Market Size & Forecast

| 2024 Market Size | 80.15 (USD Million) |

| 2035 Market Size | 250.0 (USD Million) |

| CAGR (2025 - 2035) | 10.89% |

Major Players

BASF SE (DE), Eastman Chemical Company (US), Huntsman Corporation (US), Perstorp Holding AB (SE), Mitsubishi Gas Chemical Company, Inc. (JP), Taminco (BE), Shandong Jinmei Fenghe Chemical Co., Ltd. (CN), Ferro Corporation (US)