Innovative Flavor Profiles

Innovation in flavor profiles is emerging as a significant driver for the flavored water market. South Korean consumers are increasingly drawn to unique and exotic flavors that enhance their drinking experience. This trend is evident in the introduction of flavors such as yuzu, green tea, and various fruit blends, which appeal to local tastes. The flavored water market is responding by diversifying product offerings to include these innovative flavors, thereby attracting a broader consumer base. Market data suggests that products featuring unique flavor combinations are witnessing higher sales, indicating a shift in consumer preferences towards more adventurous and diverse beverage options. This innovation not only enhances consumer engagement but also positions brands competitively within the flavored water market.

Rising Health Consciousness

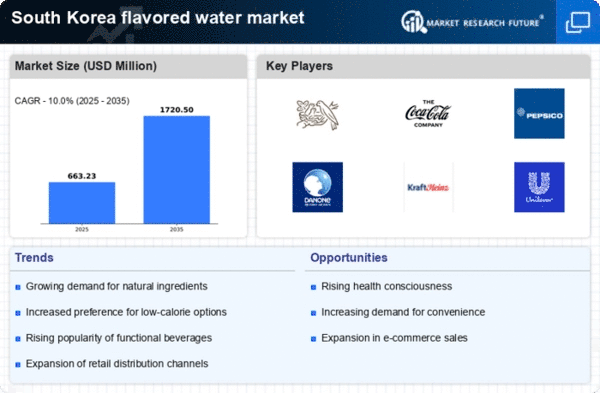

The increasing awareness of health and wellness among consumers in South Korea appears to be a primary driver for the flavored water market. As individuals become more health-conscious, they are actively seeking alternatives to sugary beverages. This shift is reflected in the flavored water market, which has seen a notable rise in demand. According to recent data, the flavored water market in South Korea is projected to grow at a CAGR of approximately 8% over the next five years. This trend indicates that consumers are gravitating towards products that offer hydration without excessive calories. The flavored water market is thus benefiting from this health trend, as brands innovate to provide low-calorie, vitamin-infused options that cater to the evolving preferences of health-oriented consumers.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of South Korean consumers is driving the demand for convenient beverage options, particularly in the flavored water market. As more individuals seek hydration solutions that fit their busy schedules, ready-to-drink flavored water products are gaining popularity. The flavored water market is adapting to this trend by offering portable packaging and single-serve options that cater to on-the-go consumption. Recent statistics indicate that convenience-oriented products account for a substantial share of the market, with sales increasing by approximately 15% in the last year. This shift underscores the importance of convenience in consumer purchasing decisions, as busy lifestyles continue to shape the beverage landscape in South Korea.

Increased Focus on Natural Ingredients

There is a growing preference for natural and organic ingredients among South Korean consumers, which is significantly influencing the flavored water market. As consumers become more discerning about the ingredients in their beverages, brands are responding by formulating products with natural flavors and no artificial additives. This trend aligns with the broader movement towards clean label products, where transparency in ingredient sourcing is paramount. The flavored water market is witnessing a surge in demand for products that emphasize natural ingredients, with Market Research Future indicating that such offerings are likely to capture a larger share of the market. This focus on naturalness not only appeals to health-conscious consumers but also enhances brand loyalty.

Sustainability and Eco-Friendly Packaging

Sustainability is becoming an increasingly vital consideration for consumers in South Korea, impacting their purchasing decisions in the flavored water market. As environmental concerns rise, consumers are favoring brands that adopt eco-friendly practices, including sustainable sourcing and packaging. The flavored water market is responding by implementing recyclable and biodegradable packaging solutions, which resonate with environmentally conscious consumers. Recent surveys indicate that approximately 70% of consumers are willing to pay a premium for products that are packaged sustainably. This trend suggests that brands prioritizing sustainability are likely to enhance their market position and appeal to a growing segment of eco-aware consumers, thereby driving growth in the flavored water market.