Increasing Healthcare Expenditure

The escalation of healthcare spending in South Korea is a pivotal factor influencing the endoscopic retrograde-cholangiopancreatography market. With the government and private sectors investing heavily in healthcare infrastructure, there is a notable increase in the availability of advanced medical technologies. In 2025, healthcare expenditure is projected to reach approximately 9% of the GDP, reflecting a commitment to improving patient care. This financial support enables hospitals to acquire cutting-edge endoscopic equipment and train medical personnel effectively. Consequently, the endoscopic retrograde-cholangiopancreatography market is likely to experience robust growth as healthcare facilities expand their capabilities to meet the rising demand for minimally invasive procedures.

Advancements in Endoscopic Technology

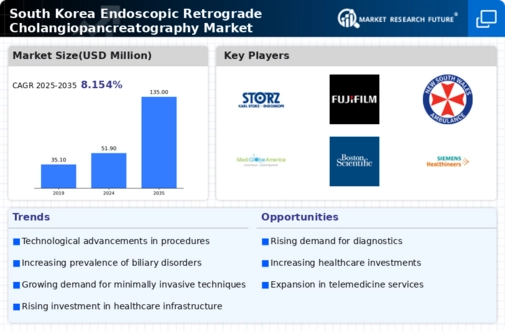

Technological innovations in endoscopic equipment are propelling the endoscopic retrograde-cholangiopancreatography market forward in South Korea. The introduction of high-definition imaging, improved endoscopes, and enhanced accessories has significantly increased the efficacy and safety of procedures. For instance, the integration of artificial intelligence in image analysis is streamlining diagnosis and treatment planning. Furthermore, the market is witnessing a shift towards single-use endoscopes, which reduce the risk of cross-contamination and improve patient safety. As hospitals and clinics invest in state-of-the-art technology, the demand for advanced endoscopic retrograde-cholangiopancreatography solutions is expected to rise, potentially leading to a market growth rate of 8-10% annually.

Growing Incidence of Biliary Disorders

The rising prevalence of biliary disorders in South Korea is a crucial driver for the endoscopic retrograde-cholangiopancreatography market. Conditions such as choledocholithiasis and cholangitis are becoming increasingly common, leading to a higher demand for diagnostic and therapeutic procedures. According to recent health statistics, biliary disorders account for a significant portion of gastrointestinal diseases, with an estimated incidence rate of 15-20 cases per 100,000 individuals annually. This trend necessitates advanced endoscopic techniques, as they provide effective solutions for managing these conditions. The endoscopic retrograde-cholangiopancreatography market is positioned to benefit from this growing patient population. Healthcare providers seek to enhance treatment outcomes and reduce complications associated with surgical interventions.

Regulatory Support for Advanced Procedures

Regulatory frameworks in South Korea are increasingly supportive of advanced medical procedures, including endoscopic retrograde-cholangiopancreatography. The government is actively promoting the adoption of innovative healthcare technologies through streamlined approval processes and reimbursement policies. This regulatory environment encourages healthcare providers to implement the latest endoscopic techniques, enhancing patient access to effective treatments. Additionally, the establishment of guidelines for best practices in endoscopic procedures is likely to improve safety and efficacy, further boosting confidence among practitioners. As a result, the endoscopic retrograde-cholangiopancreatography market is expected to thrive, with an anticipated growth trajectory driven by favorable regulatory conditions.

Rising Awareness of Gastrointestinal Health

There is a growing awareness of gastrointestinal health among the South Korean population, which is positively impacting the endoscopic retrograde-cholangiopancreatography market. Public health campaigns and educational initiatives are informing individuals about the importance of early detection and treatment of biliary diseases. This heightened awareness is leading to an increase in patient consultations and screenings, thereby driving demand for endoscopic procedures. As more patients seek timely interventions, healthcare providers are likely to expand their endoscopic services, further propelling the market. The trend suggests that the endoscopic retrograde-cholangiopancreatography market could see a surge in utilization rates, potentially increasing by 15-20% over the next few years.