Rising Healthcare Expenditure

The increase in healthcare expenditure in South Korea is a significant driver for the dyspepsia market. With the government and private sectors investing more in healthcare services, there is a greater availability of resources for the diagnosis and treatment of dyspepsia. Reports indicate that healthcare spending has risen by approximately 7% annually, leading to improved access to medical care and treatment options for patients. This trend may encourage more individuals to seek help for their dyspeptic symptoms, thereby expanding the market. Additionally, as healthcare facilities enhance their services, the dyspepsia market could see a rise in the development of innovative therapies and patient management programs.

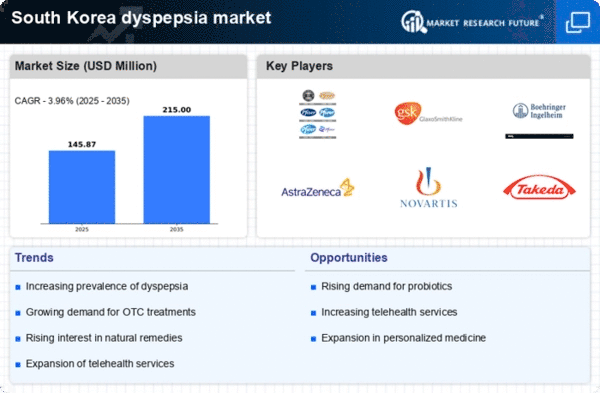

Increasing Prevalence of Dyspepsia

The rising incidence of dyspepsia in South Korea is a crucial driver for the dyspepsia market. Recent studies indicate that approximately 25% of the population experiences dyspeptic symptoms at some point in their lives. This growing prevalence is attributed to lifestyle changes, dietary habits, and increased stress levels. As more individuals seek medical attention for their symptoms, the demand for effective treatments and diagnostic tools in the dyspepsia market is likely to surge. Furthermore, healthcare providers are increasingly focusing on managing dyspepsia, which may lead to enhanced patient education and awareness. This trend could potentially result in a more significant market share for pharmaceutical companies and healthcare services specializing in gastrointestinal health.

Growing Interest in Herbal Remedies

The increasing interest in herbal and natural remedies is shaping the dyspepsia market in South Korea. Many consumers are turning to traditional medicine and herbal supplements as alternatives to conventional treatments for dyspepsia. This trend is partly driven by a cultural inclination towards natural healing methods and a desire to avoid potential side effects associated with pharmaceutical drugs. The market for herbal products is projected to grow, with consumers seeking effective solutions for digestive health. As a result, companies in the dyspepsia market may need to adapt their offerings to include herbal options, catering to the preferences of a more health-conscious population.

Shift Towards Preventive Healthcare

There is a notable shift towards preventive healthcare in South Korea, which significantly impacts the dyspepsia market. As the population becomes more health-conscious, individuals are increasingly seeking preventive measures to avoid gastrointestinal disorders. This trend is reflected in the growing demand for dietary supplements, probiotics, and lifestyle modification programs aimed at reducing dyspeptic symptoms. The South Korean government has also initiated various health campaigns promoting digestive health, which may further encourage individuals to adopt preventive strategies. Consequently, this proactive approach could lead to an expansion of the dyspepsia market, as consumers invest in products and services that support gastrointestinal well-being.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic tools are transforming the dyspepsia market in South Korea. The introduction of advanced imaging techniques and non-invasive testing methods has improved the accuracy of dyspepsia diagnoses. For instance, the use of endoscopy and breath tests has become more prevalent, allowing for quicker and more reliable assessments of gastrointestinal health. These advancements not only enhance patient outcomes but also drive the demand for related medical devices and services. As healthcare providers adopt these technologies, the dyspepsia market is likely to experience growth, with increased investment in research and development to further improve diagnostic capabilities.