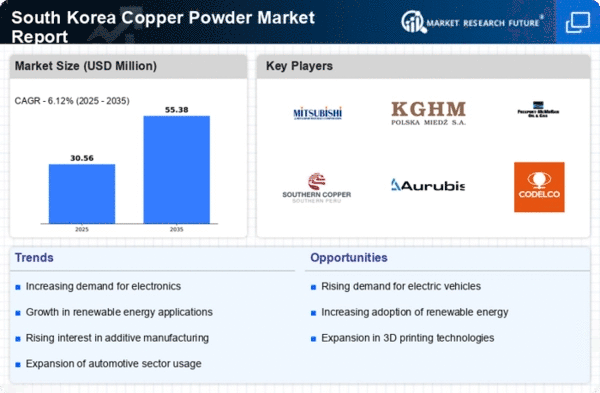

The copper powder market exhibits a dynamic competitive landscape characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for advanced materials in electronics, automotive, and renewable energy sectors. Major companies such as Mitsubishi Materials Corporation (Japan), KGHM Polska Miedz S.A. (Poland), and Aurubis AG (Germany) are strategically positioned to leverage these trends. Mitsubishi Materials Corporation (Japan) focuses on innovation in production techniques, enhancing the quality and efficiency of its copper powder offerings. KGHM Polska Miedz S.A. (Poland) emphasizes regional expansion and sustainability initiatives, while Aurubis AG (Germany) is investing in digital transformation to optimize its supply chain and production processes. Collectively, these strategies shape a competitive environment that is increasingly focused on technological advancement and sustainability.Key business tactics within the market include localizing manufacturing to reduce costs and enhance supply chain resilience. The competitive structure appears moderately fragmented, with several key players exerting influence over market dynamics. This fragmentation allows for niche players to emerge, yet the collective strength of major companies like Southern Copper Corporation (US) and Freeport-McMoRan Inc. (US) remains significant, as they continue to dominate in terms of production capacity and market share.

In October Southern Copper Corporation (US) announced a strategic partnership with a leading technology firm to develop advanced copper powder production methods. This collaboration aims to enhance the efficiency of their manufacturing processes, potentially reducing production costs by up to 15%. Such a move underscores the company's commitment to innovation and positions it favorably against competitors in a rapidly evolving market.

In September KGHM Polska Miedz S.A. (Poland) launched a new sustainability initiative aimed at reducing carbon emissions in its copper powder production by 30% over the next five years. This initiative not only aligns with global sustainability trends but also enhances the company's reputation as a responsible producer, likely attracting environmentally conscious customers and investors.

In August Aurubis AG (Germany) unveiled a digital platform designed to streamline its supply chain operations, which is expected to improve delivery times by 20%. This digital transformation reflects a broader trend within the industry, where companies are increasingly adopting technology to enhance operational efficiency and customer satisfaction.

As of November current competitive trends are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance innovation and operational efficiency. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, sustainability practices, and supply chain reliability. This shift suggests that companies that prioritize innovation and responsible production will be better positioned to thrive in the future.