Collaboration Among Industry Players

The blockchain supply chain market is witnessing a trend of increased collaboration among industry players in South Korea. Companies are recognizing the benefits of working together to develop and implement blockchain solutions that enhance supply chain efficiency. Collaborative initiatives, such as consortiums and partnerships, are emerging as key drivers of innovation in the market. By pooling resources and expertise, organizations can accelerate the development of blockchain applications tailored to their specific needs. This collaborative approach is expected to foster a more robust blockchain supply-chain market, as companies leverage shared knowledge and technology to address common challenges and improve overall supply chain performance.

Consumer Demand for Ethical Sourcing

In South Korea, there is a growing consumer demand for ethically sourced products, which is significantly impacting the blockchain supply-chain market. Consumers are increasingly concerned about the origins of their products and the ethical practices of companies. Blockchain technology offers a solution by providing transparent and immutable records of product sourcing and manufacturing processes. This transparency allows consumers to verify claims regarding sustainability and ethical practices. As a result, businesses are adopting blockchain solutions to meet consumer expectations, which is likely to drive market growth. The blockchain supply-chain market may see an increase in adoption rates as companies strive to align with consumer values.

Enhanced Security and Fraud Prevention

Security concerns remain a critical issue in supply chain management, prompting a shift towards blockchain technology. The blockchain supply-chain market is poised to benefit from the heightened focus on security and fraud prevention. By utilizing decentralized ledgers, companies can ensure data integrity and authenticity, significantly reducing the risk of fraud. In South Korea, the implementation of blockchain solutions has led to a 40% decrease in counterfeit products within supply chains. This enhanced security not only protects businesses but also fosters consumer trust, which is essential for market growth. As security becomes a priority, the blockchain supply-chain market is expected to expand as more companies seek to safeguard their operations.

Rising Demand for Supply Chain Efficiency

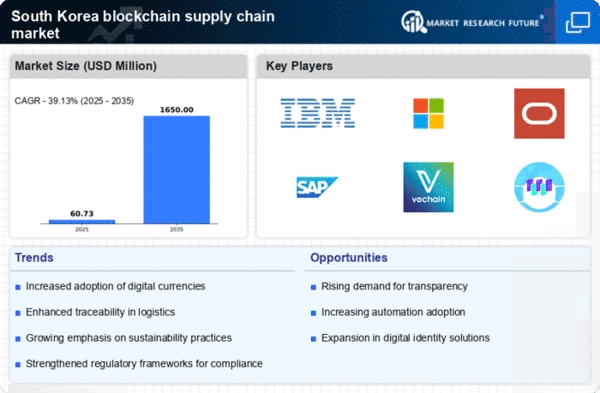

The blockchain supply-chain market in South Korea is experiencing a notable surge in demand for enhanced supply chain efficiency. Companies are increasingly recognizing the potential of blockchain technology to streamline operations, reduce costs, and improve overall productivity. According to recent data, businesses that have adopted blockchain solutions report a reduction in operational costs by up to 30%. This trend is driven by the need for real-time data access and improved collaboration among supply chain partners. As organizations strive to optimize their supply chains, the blockchain supply-chain market is likely to see significant growth, with projections indicating a compound annual growth rate (CAGR) of 25% over the next five years.

Growing Regulatory Compliance Requirements

The blockchain supply chain market is increasingly influenced by the evolving landscape of regulatory compliance in South Korea. As governments impose stricter regulations on supply chain transparency and accountability, businesses are compelled to adopt blockchain solutions to meet these requirements. The market is witnessing a shift as companies leverage blockchain technology to ensure compliance with local and international standards. For instance, the South Korean government has introduced regulations that mandate traceability in food supply chains, driving the adoption of blockchain solutions. This trend is likely to propel the blockchain supply-chain market forward, as organizations seek to avoid penalties and enhance their compliance capabilities.