Government Initiatives and Support

Government initiatives and support play a crucial role in shaping the automation as-a-service market in South Korea. The South Korean government has been actively promoting digital transformation across various sectors, providing funding and resources to encourage the adoption of automation technologies. Recent policies aimed at enhancing the competitiveness of local businesses have led to increased investments in automation solutions. For example, the government has allocated approximately $500 million to support small and medium-sized enterprises in their automation journeys. This proactive approach not only fosters innovation but also creates a conducive environment for the growth of the automation as-a-service market. As government backing continues, it is likely to stimulate further advancements and adoption of automation technologies across industries.

Shift Towards Remote Work Solutions

The shift towards remote work solutions is significantly influencing the automation as-a-service market in South Korea. As organizations adapt to new work environments, there is a growing need for automated solutions that facilitate remote collaboration and productivity. Tools that automate project management, communication, and workflow processes are becoming essential for maintaining operational continuity. Data indicates that companies utilizing automation tools for remote work have seen a 25% increase in employee satisfaction and engagement. This trend is likely to persist as businesses recognize the long-term benefits of flexible work arrangements. Consequently, the automation as-a-service market is expected to expand, driven by the demand for solutions that support remote work dynamics and enhance overall efficiency.

Integration of Advanced Technologies

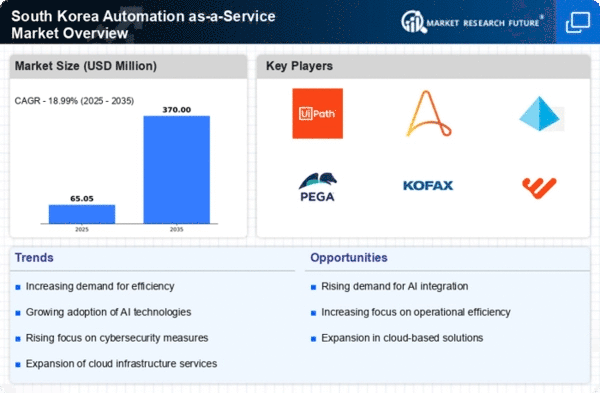

The integration of advanced technologies is a pivotal driver for the automation as-a-service market in South Korea. The convergence of artificial intelligence, machine learning, and the Internet of Things (IoT) is transforming traditional business models. Companies are leveraging these technologies to create more intelligent and responsive systems. For instance, the automation of customer service processes through AI chatbots has shown to improve response times by 50%. This technological evolution not only enhances service delivery but also reduces operational costs. As organizations increasingly adopt these advanced solutions, the automation as-a-service market is expected to grow, with estimates suggesting a compound annual growth rate (CAGR) of 20% over the next five years. This driver underscores the importance of technological integration in driving market expansion.

Rising Demand for Operational Efficiency

The automation as-a-service market in South Korea is experiencing a notable surge in demand for operational efficiency. Businesses are increasingly recognizing the need to streamline processes and reduce manual intervention. This trend is driven by the desire to enhance productivity and minimize errors. According to recent data, companies that have adopted automation solutions report a productivity increase of up to 30%. This shift towards automation is not merely a trend but a strategic move to remain competitive in a rapidly evolving market. As organizations seek to optimize their operations, the automation as-a-service market is poised for significant growth, with projections indicating a potential market size expansion to $1 billion by 2026. This driver highlights the critical role of automation in achieving operational excellence.

Focus on Compliance and Regulatory Standards

The focus on compliance and regulatory standards is emerging as a significant driver for the automation as-a-service market in South Korea. With increasing scrutiny from regulatory bodies, businesses are compelled to adopt automation solutions that ensure adherence to legal and industry standards. Automation tools that streamline compliance processes not only mitigate risks but also enhance operational transparency. For instance, organizations that implement automated compliance monitoring systems can reduce the time spent on audits by up to 40%. This emphasis on compliance is likely to propel the growth of the automation as-a-service market, as companies seek to leverage technology to navigate complex regulatory landscapes effectively. As compliance requirements evolve, the demand for automation solutions that address these challenges will continue to rise.