Supportive Regulatory Environment

The regulatory environment in South America is becoming increasingly supportive of the transradial access-devices market. Regulatory bodies are streamlining the approval processes for new medical devices, which facilitates quicker market entry for innovative products. This trend is particularly evident in countries like Chile and Colombia, where regulatory reforms have been implemented to encourage the adoption of advanced medical technologies. As a result, manufacturers are more likely to invest in the development of transradial access devices, knowing that they can navigate the regulatory landscape more efficiently. This supportive environment is likely to foster growth in the transradial access-devices market, as new products become available to healthcare providers.

Rising Awareness of Patient Safety

There is a growing awareness regarding patient safety and the importance of minimizing complications during medical procedures in South America. This trend is influencing the transradial access-devices market, as these devices are known for their safety profile compared to traditional femoral access methods. Studies indicate that transradial access can reduce the risk of bleeding complications by up to 50%. As healthcare providers prioritize patient safety, the adoption of transradial access devices is likely to increase. This shift not only enhances patient outcomes but also aligns with the broader goals of healthcare systems in South America to improve overall quality of care.

Technological Innovations in Medical Devices

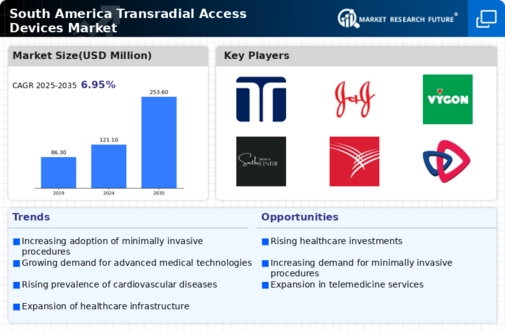

The transradial access-devices market is being propelled by rapid technological innovations in medical devices. Manufacturers are increasingly focusing on developing advanced transradial access devices that offer enhanced functionality, ease of use, and improved patient comfort. Innovations such as integrated imaging systems and ergonomic designs are becoming more prevalent, making these devices more appealing to healthcare professionals. The market is projected to grow at a CAGR of around 8% over the next five years, driven by these technological advancements. As healthcare providers seek to adopt the latest technologies to improve procedural efficiency, the demand for innovative transradial access devices is expected to rise.

Growing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in South America is a primary driver for the transradial access-devices market. According to health statistics, cardiovascular diseases account for approximately 30% of all deaths in the region. This alarming trend has prompted healthcare providers to adopt innovative solutions, including transradial access devices, which are associated with lower complication rates and faster recovery times. As the population ages and lifestyle-related health issues become more prevalent, the demand for effective cardiovascular interventions is expected to increase. Consequently, the transradial access-devices market is likely to experience substantial growth as healthcare systems strive to enhance patient outcomes and reduce the burden of cardiovascular diseases.

Increased Investment in Healthcare Infrastructure

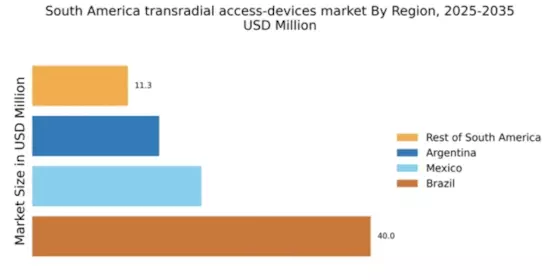

South America is witnessing a surge in healthcare infrastructure investments, which is significantly impacting the transradial access-devices market. Governments and private entities are allocating substantial funds to improve healthcare facilities, particularly in urban areas. This investment is aimed at modernizing hospitals and clinics, thereby enhancing the availability of advanced medical technologies, including transradial access devices. For instance, Brazil and Argentina have reported increases in healthcare spending by over 10% annually, which is expected to facilitate the adoption of innovative medical devices. As healthcare infrastructure continues to develop, the transradial access-devices market is poised for growth, driven by improved access to quality healthcare services.