Growing Aging Population

The growing aging population in South America is a critical driver for the stethoscope market. As the demographic shifts towards an older population, there is an increased prevalence of age-related health issues, such as hypertension and respiratory diseases. This demographic change is prompting healthcare providers to invest in diagnostic tools that can aid in the management of these conditions. Projections indicate that by 2030, the elderly population in South America will account for over 15% of the total population. Consequently, the demand for stethoscopes is likely to rise as healthcare systems adapt to meet the needs of this demographic.

Emergence of Telemedicine

The emergence of telemedicine in South America is reshaping the stethoscope market. As healthcare providers increasingly adopt telehealth solutions, the need for portable and efficient diagnostic tools becomes paramount. Stethoscopes that can connect to telemedicine platforms are gaining traction, allowing healthcare professionals to conduct remote examinations. This trend is particularly relevant in rural areas where access to healthcare is limited. The telemedicine market in South America is projected to grow by 40% over the next five years, indicating a substantial opportunity for stethoscope manufacturers to innovate and cater to this evolving landscape.

Rising Demand for Diagnostic Tools

The stethoscope market in South America is experiencing a notable increase in demand for diagnostic tools. This trend is driven by the growing prevalence of chronic diseases, which necessitate regular monitoring and early detection. According to recent data, the incidence of cardiovascular diseases in South America has risen by approximately 30% over the past decade. As healthcare providers seek to enhance patient outcomes, the stethoscope remains a fundamental instrument in clinical settings. The increasing focus on accurate diagnostics is likely to propel the stethoscope market forward, as healthcare professionals rely on these devices for effective patient assessments.

Increased Focus on Medical Training

An increased focus on medical training and education in South America is contributing to the growth of the stethoscope market. Medical schools and training programs are emphasizing the importance of hands-on experience with diagnostic tools. As a result, students are being equipped with stethoscopes as part of their training, leading to higher demand in the educational sector. Reports indicate that enrollment in medical programs has surged by 25% in the last five years, which correlates with a rising need for stethoscopes. This trend suggests that the stethoscope market will continue to thrive as future healthcare professionals are trained to utilize these essential instruments.

Expansion of Healthcare Infrastructure

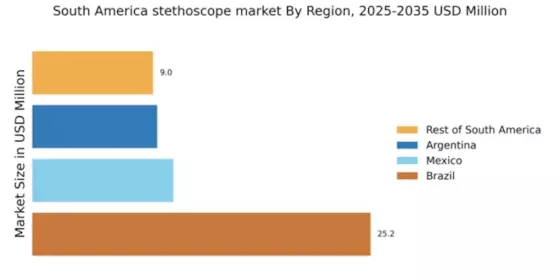

The expansion of healthcare infrastructure across South America is significantly impacting the stethoscope market. Governments and private entities are investing heavily in healthcare facilities, aiming to improve access to medical services. For instance, Brazil and Argentina have reported a combined investment of over $5 billion in healthcare infrastructure in recent years. This expansion includes the establishment of new hospitals and clinics, which in turn drives the demand for essential medical equipment, including stethoscopes. As more healthcare facilities become operational, the need for reliable diagnostic tools is expected to rise, thereby benefiting the stethoscope market.