Government Initiatives for Eye Health

Government initiatives aimed at improving eye health in South America are significantly impacting the pupillometer market. Various health ministries are launching campaigns to promote regular eye examinations and the use of advanced diagnostic tools. These initiatives often include funding for healthcare facilities to acquire pupillometers, thereby increasing their availability in both urban and rural settings. As a result, the market is expected to expand, with a projected increase in pupillometer sales by 20% over the next five years. Such government support not only enhances public awareness but also encourages healthcare providers to invest in modern diagnostic equipment, thereby fostering growth in the industry.

Growing Demand for Eye Care Solutions

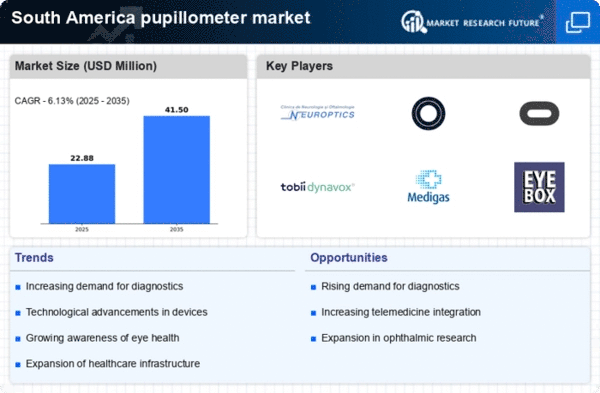

The increasing prevalence of eye-related disorders in South America is driving the demand for advanced diagnostic tools, including pupillometers. As the population ages, the incidence of conditions such as glaucoma and diabetic retinopathy rises, necessitating effective monitoring and assessment methods. The pupillometer market is witnessing a surge in demand, with estimates suggesting a growth rate of approximately 8% annually. This trend is further supported by healthcare initiatives aimed at improving eye care services across the region, leading to a greater adoption of pupillometry in clinical settings. Enhanced awareness of the importance of early diagnosis and treatment is likely to propel the market forward, as healthcare providers seek reliable tools to aid in patient management.

Integration of Telemedicine in Eye Care

The integration of telemedicine into healthcare systems in South America is transforming the pupillometer market. Telemedicine facilitates remote consultations and monitoring, allowing healthcare professionals to utilize pupillometers for virtual assessments. This trend is particularly relevant in rural areas where access to specialized eye care is limited. The convenience of remote diagnostics is expected to increase the adoption of pupillometers, as patients can receive timely evaluations without the need for extensive travel. Market analysts project that the telemedicine sector will grow by over 15% in the coming years, further enhancing the demand for pupillometry as a critical component of remote eye care solutions.

Increased Focus on Research and Development

The increased focus on research and development (R&D) within the healthcare sector in South America is influencing the pupillometer market. As academic institutions and private companies invest in R&D, new and improved pupillometer technologies are emerging, enhancing diagnostic accuracy and usability. This focus on innovation is likely to attract more healthcare providers to adopt pupillometry as a standard practice in eye care. Furthermore, collaborations between universities and healthcare organizations are expected to yield advancements that could lead to a 25% increase in the effectiveness of pupillometers. Such developments not only improve patient care but also stimulate market growth as new products enter the market.

Rising Investment in Healthcare Infrastructure

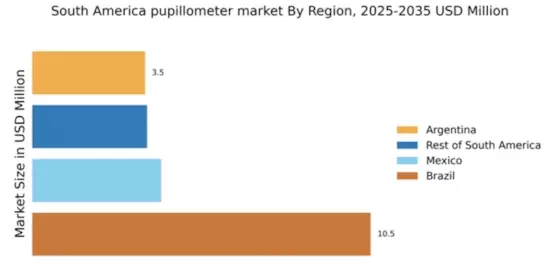

The rising investment in healthcare infrastructure across South America is poised to benefit the pupillometer market. As governments and private entities allocate more resources to enhance healthcare facilities, the demand for advanced diagnostic equipment, including pupillometers, is likely to increase. This trend is evident in countries like Brazil and Argentina, where significant funding is directed towards modernizing hospitals and clinics. The market is projected to experience a compound annual growth rate (CAGR) of 10% as healthcare providers seek to improve patient outcomes through the adoption of innovative technologies. Enhanced infrastructure not only facilitates the acquisition of pupillometers but also promotes their integration into routine eye care practices.