Growing Livestock Population

The increasing livestock population in South America is a primary driver for the porcine vaccines market. As the demand for pork rises, driven by both domestic consumption and export opportunities, the need for effective vaccination strategies becomes paramount. In 2025, the region's pig population is estimated to reach approximately 50 million, necessitating robust vaccination programs to ensure herd health and productivity. This growth in livestock numbers correlates with a heightened focus on disease prevention, thereby propelling the porcine vaccines market. Furthermore, the economic implications of livestock health are significant, as outbreaks can lead to substantial financial losses, estimated at millions of dollars annually. Consequently, the expansion of the livestock sector directly influences the demand for innovative and effective vaccines, underscoring the importance of this driver in the porcine vaccines market.

Rising Awareness of Animal Welfare

The growing awareness of animal welfare among consumers and producers in South America is a significant driver for the porcine vaccines market. As consumers increasingly demand ethically raised pork, producers are compelled to adopt practices that ensure the health and well-being of their livestock. This shift in consumer preferences is leading to a greater emphasis on vaccination as a means of preventing disease and promoting animal welfare. In 2025, it is anticipated that the market for porcine vaccines could see an increase of around 10% as producers invest in vaccination programs to meet these expectations. Furthermore, the integration of animal welfare standards into production practices is likely to enhance the reputation of pork products, thereby driving demand for effective vaccines within the porcine vaccines market.

Regulatory Support for Animal Health

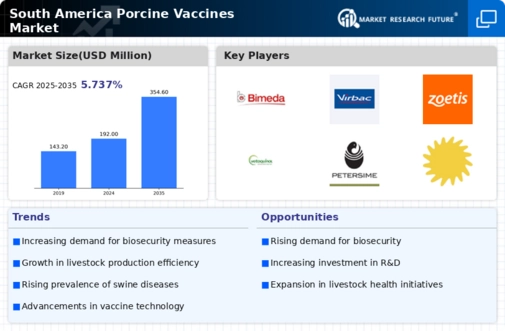

Regulatory frameworks in South America increasingly emphasize animal health, which significantly impacts the porcine vaccines market. Governments are implementing stricter regulations to ensure the safety and efficacy of vaccines, thereby fostering a conducive environment for vaccine development and distribution. For instance, the establishment of guidelines for vaccine approval processes has streamlined the introduction of new products into the market. This regulatory support not only enhances consumer confidence but also encourages investment in research and development. In 2025, it is projected that the market for porcine vaccines could grow by approximately 15% due to these supportive policies. As a result, the alignment of regulatory measures with industry needs is likely to drive innovation and accessibility in the porcine vaccines market, ultimately benefiting livestock health and productivity.

Technological Innovations in Vaccine Delivery

Technological advancements in vaccine delivery systems are emerging as a crucial driver for the porcine vaccines market in South America. Innovations such as needle-free vaccination and oral vaccines are gaining traction, offering more efficient and less stressful methods for administering vaccines to pigs. These advancements not only improve the overall vaccination experience for animals but also enhance the effectiveness of vaccine uptake. In 2025, the adoption of these technologies is expected to contribute to a market growth rate of approximately 12%. As producers seek to optimize their vaccination strategies, the integration of these innovative delivery methods is likely to play a pivotal role in shaping the future of the porcine vaccines market, ultimately leading to healthier livestock and improved production outcomes.

Economic Growth and Increased Pork Consumption

The economic growth observed in several South American countries is driving an increase in pork consumption, which in turn fuels the porcine vaccines market. As disposable incomes rise, consumers are more inclined to purchase pork products, leading to a surge in demand for healthy and disease-free livestock. This trend is particularly evident in urban areas, where pork is a staple protein source. In 2025, it is projected that pork consumption in the region could rise by 8%, necessitating enhanced vaccination efforts to maintain herd health and productivity. Consequently, the economic landscape directly influences the porcine vaccines market, as producers invest in vaccination programs to meet the growing demand for quality pork products.