Supportive Government Policies

Supportive government policies in South America are fostering a conducive environment for the plasma fractionation market. Regulatory frameworks are being established to streamline the approval processes for plasma-derived therapies, ensuring that they reach the market more efficiently. Additionally, governments are incentivizing research and development in this field, which could lead to innovative products and therapies. As a result, the plasma fractionation market is likely to experience accelerated growth, with projections indicating a potential increase in market size by 8% over the next five years. This supportive landscape is essential for attracting investments and enhancing the overall market dynamics.

Increasing Healthcare Expenditure

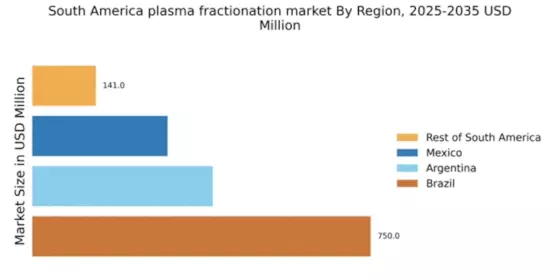

The rising healthcare expenditure in South America is a pivotal driver for the plasma fractionation market. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of advanced medical technologies. In 2025, healthcare spending in South America is projected to reach approximately $500 billion, reflecting a growth rate of around 5% annually. This increase in funding allows for better access to plasma-derived therapies, thereby enhancing the demand for immunoglobulins and other plasma products. As healthcare systems evolve, the plasma fractionation market is likely to benefit from improved facilities and increased patient access to essential treatments, which could further stimulate market growth.

Growing Prevalence of Chronic Diseases

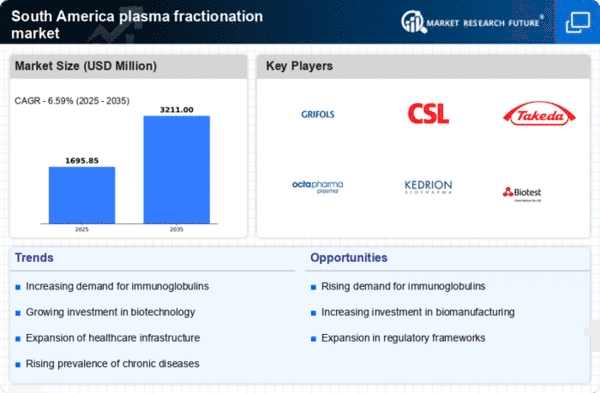

The prevalence of chronic diseases in South America is escalating, which significantly impacts the plasma fractionation market. Conditions such as autoimmune disorders, hemophilia, and other blood-related diseases are becoming more common, necessitating the use of plasma-derived therapies. Reports indicate that chronic diseases account for nearly 60% of all deaths in the region, highlighting the urgent need for effective treatment options. This growing patient population is likely to drive demand for immunoglobulins and clotting factors, thereby propelling the plasma fractionation market. As healthcare providers seek to address these challenges, the industry is expected to expand to meet the increasing therapeutic needs.

Advancements in Plasma Collection Techniques

Innovations in plasma collection techniques are emerging as a crucial driver for the plasma fractionation market in South America. Enhanced methods for plasma collection, such as automated apheresis, are improving the efficiency and safety of the process. These advancements not only increase the yield of plasma but also ensure better quality, which is essential for producing high-quality plasma-derived products. As a result, the market is likely to see a rise in the availability of immunoglobulins and clotting factors, meeting the growing demand from healthcare providers. The ongoing development of these technologies could potentially lead to a market growth rate of 6% over the next few years.

Rising Awareness of Plasma-Derived Therapies

There is a notable increase in awareness regarding the benefits of plasma-derived therapies among healthcare professionals and patients in South America. Educational initiatives and outreach programs are being implemented to inform stakeholders about the efficacy of these treatments for various medical conditions. This heightened awareness is likely to lead to increased prescriptions and utilization of plasma products, thereby driving growth in the plasma fractionation market. As more patients become informed about their treatment options, the demand for immunoglobulins and other plasma-derived therapies is expected to rise, potentially leading to a market expansion of around 7% annually.