-

EXECUTIVE

-

SUMMARY

-

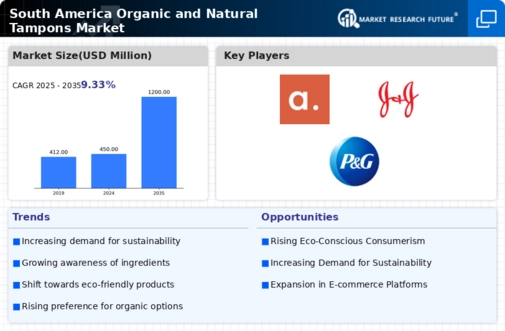

Market Overview

-

Key Findings

-

Market Segmentation

-

Competitive Landscape

-

Challenges and Opportunities

-

Future Outlook

-

MARKET INTRODUCTION

-

Definition

-

Scope of the study

-

Research Objective

-

Assumption

-

Limitations

-

RESEARCH

-

METHODOLOGY

-

Overview

-

Data

-

Mining

-

Secondary Research

-

Primary

-

Research

-

Primary Interviews and Information Gathering

-

Process

-

Breakdown of Primary Respondents

-

Forecasting

-

Model

-

Market Size Estimation

-

Bottom-Up

-

Approach

-

Top-Down Approach

-

Data

-

Triangulation

-

Validation

-

MARKET

-

DYNAMICS

-

Overview

-

Drivers

-

Restraints

-

Opportunities

-

MARKET FACTOR ANALYSIS

-

Value chain Analysis

-

Porter's

-

Five Forces Analysis

-

Bargaining Power of Suppliers

-

Bargaining

-

Power of Buyers

-

Threat of New Entrants

-

Threat

-

of Substitutes

-

Intensity of Rivalry

-

COVID-19

-

Impact Analysis

-

Market Impact Analysis

-

Regional

-

Impact

-

Opportunity and Threat Analysis

-

South

-

America Organic and Natural Tampons Market, BY Type (USD Million)

-

Cardboard

-

Applicator

-

Plastic Applicator

-

Digital

-

Tampon

-

South America Organic

-

and Natural Tampons Market, BY Size (USD Million)

-

Junior

-

Tampons

-

Regular Tampons

-

Super

-

Super-Plus

-

South

-

America Organic and Natural Tampons Market, BY Odour (USD Million)

-

Fragrance

-

Based

-

Non-Fragrance Based

-

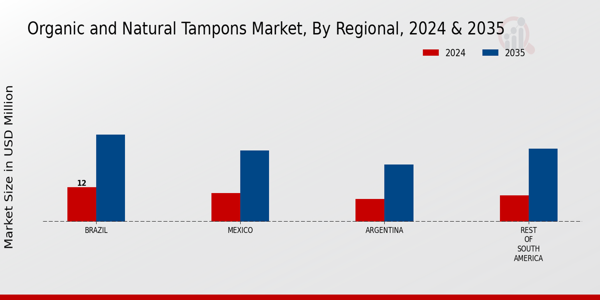

South

-

America Organic and Natural Tampons Market, BY Regional (USD Million)

-

Brazil

-

Mexico

-

Argentina

-

Rest

-

of South America

-

Competitive Landscape

-

Overview

-

Competitive

-

Analysis

-

Market share Analysis

-

Major

-

Growth Strategy in the Organic and Natural Tampons Market

-

Competitive

-

Benchmarking

-

Leading Players in Terms of Number of Developments

-

in the Organic and Natural Tampons Market

-

Key developments

-

and growth strategies

-

New Product Launch/Service Deployment

-

Merger

-

& Acquisitions

-

Joint Ventures

-

Major

-

Players Financial Matrix

-

Sales and Operating Income

-

Major

-

Players R&D Expenditure. 2023

-

Company

-

Profiles

-

Lola

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Thinx

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Tampon Tribe

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Hello Cup

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

KimberlyClark

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Ruby Cup

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Be informed

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Procter & Gamble

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Natracare

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Herbal Essences

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Cora

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Organicup

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Rael

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

Unilever

-

Financial

-

Overview

-

Products Offered

-

Key

-

Developments

-

SWOT Analysis

-

Key

-

Strategies

-

References

-

Related

-

Reports

-

LIST

-

OF ASSUMPTIONS

-

South America Organic and Natural Tampons

-

Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

South

-

America Organic and Natural Tampons Market SIZE ESTIMATES & FORECAST, BY SIZE,

-

2035 (USD Billions)

-

South America Organic and Natural

-

Tampons Market SIZE ESTIMATES & FORECAST, BY ODOUR, 2019-2035 (USD Billions)

-

South

-

America Organic and Natural Tampons Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

2035 (USD Billions)

-

PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

-

ACQUISITION/PARTNERSHIP

-

LIST

-

Of figures

-

MARKET SYNOPSIS

-

SOUTH

-

AMERICA ORGANIC AND NATURAL TAMPONS MARKET ANALYSIS BY TYPE

-

SOUTH

-

AMERICA ORGANIC AND NATURAL TAMPONS MARKET ANALYSIS BY SIZE

-

SOUTH

-

AMERICA ORGANIC AND NATURAL TAMPONS MARKET ANALYSIS BY ODOUR

-

SOUTH

-

AMERICA ORGANIC AND NATURAL TAMPONS MARKET ANALYSIS BY REGIONAL

-

KEY

-

BUYING CRITERIA OF ORGANIC AND NATURAL TAMPONS MARKET

-

RESEARCH

-

PROCESS OF MRFR

-

DRO ANALYSIS OF ORGANIC AND NATURAL TAMPONS

-

MARKET

-

DRIVERS IMPACT ANALYSIS: ORGANIC AND NATURAL TAMPONS

-

MARKET

-

RESTRAINTS IMPACT ANALYSIS: ORGANIC AND NATURAL

-

TAMPONS MARKET

-

SUPPLY / VALUE CHAIN: ORGANIC AND NATURAL

-

TAMPONS MARKET

-

ORGANIC AND NATURAL TAMPONS MARKET, BY

-

TYPE, 2025 (% SHARE)

-

ORGANIC AND NATURAL TAMPONS MARKET,

-

BY TYPE, 2019 TO 2035 (USD Billions)

-

ORGANIC AND NATURAL

-

TAMPONS MARKET, BY SIZE, 2025 (% SHARE)

-

ORGANIC AND NATURAL

-

TAMPONS MARKET, BY SIZE, 2019 TO 2035 (USD Billions)

-

ORGANIC

-

AND NATURAL TAMPONS MARKET, BY ODOUR, 2025 (% SHARE)

-

ORGANIC

-

AND NATURAL TAMPONS MARKET, BY ODOUR, 2019 TO 2035 (USD Billions)

-

ORGANIC

-

AND NATURAL TAMPONS MARKET, BY REGIONAL, 2025 (% SHARE)

-

ORGANIC

-

AND NATURAL TAMPONS MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

-

BENCHMARKING

-

OF MAJOR COMPETITORS