Rising Healthcare Expenditure

The increase in healthcare expenditure across South America is contributing to the growth of the organ preservation market. As governments and private sectors invest more in healthcare infrastructure, there is a greater focus on improving transplant services and organ preservation techniques. This trend is reflected in the healthcare spending, which has risen by approximately 8% annually in several South American countries. Enhanced funding allows for better training of medical professionals and the acquisition of advanced preservation technologies, ultimately leading to improved outcomes in organ transplantation.

Regulatory Support for Organ Donation

Government initiatives aimed at promoting organ donation are playing a crucial role in shaping the organ preservation market in South America. Regulatory frameworks that facilitate organ donation and transplantation are being strengthened, which may lead to an increase in available organs for transplantation. For instance, several countries in the region have implemented policies to encourage organ donation, resulting in a reported increase of 20% in organ availability. This regulatory support not only boosts the number of transplants but also emphasizes the importance of effective organ preservation techniques to maximize the potential of donated organs.

Increasing Demand for Organ Transplants

The rising incidence of chronic diseases and organ failures in South America is driving the demand for organ transplants. As the population ages, the need for organ transplants is expected to increase significantly. This trend is likely to propel the organ preservation market, as effective preservation techniques are essential for successful transplant outcomes. According to recent data, the number of organ transplants in South America has increased by approximately 15% over the past five years. This growing demand necessitates advancements in preservation methods to ensure the viability of organs during transportation and storage, thereby enhancing the overall success rates of transplant procedures.

Advancements in Preservation Technologies

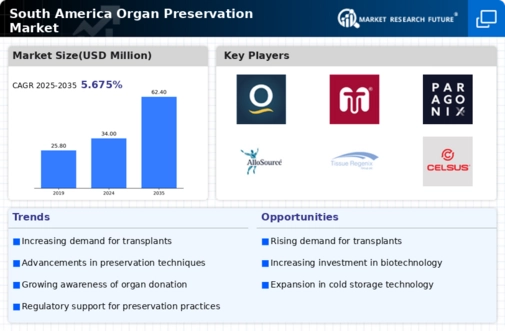

Innovations in preservation technologies are significantly impacting the organ preservation market in South America. Techniques such as hypothermic machine perfusion and novel preservation solutions are being developed to enhance organ viability. These advancements are crucial, as they can extend the preservation time of organs, thereby increasing the chances of successful transplants. The market for organ preservation technologies is projected to grow at a CAGR of 10% over the next five years, driven by these technological advancements. As hospitals and transplant centers adopt these new methods, the overall efficiency and success rates of organ transplants are likely to improve.

Collaboration Among Healthcare Institutions

Collaboration among healthcare institutions is emerging as a key driver for the organ preservation market in South America. Partnerships between hospitals, research institutions, and biotechnology companies are fostering innovation in preservation methods. These collaborations facilitate the sharing of knowledge and resources, which can lead to the development of more effective preservation techniques. As a result, the success rates of organ transplants are likely to improve, encouraging more patients to consider transplantation as a viable option. This collaborative approach is expected to enhance the overall landscape of organ preservation in the region.