Rising Healthcare Expenditure

The increase in healthcare expenditure across South America is contributing to the expansion of the nanomedicine market. As governments and private sectors allocate more resources to healthcare, there is a growing focus on adopting advanced medical technologies, including nanomedicine. According to recent reports, healthcare spending in the region is projected to reach $500 billion by 2027. This surge in investment is likely to enhance access to innovative treatments and improve healthcare infrastructure. Consequently, the demand for nanomedicine solutions is expected to rise, as healthcare providers seek to leverage these technologies to enhance patient care and treatment outcomes.

Advancements in Nanotechnology

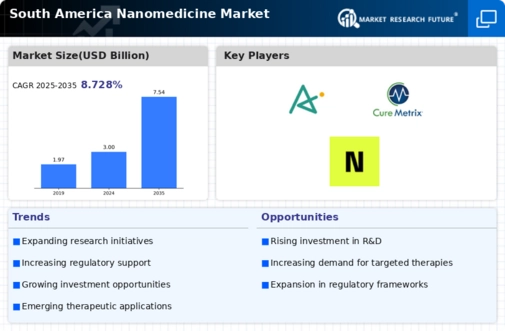

Technological advancements in nanotechnology are significantly influencing the nanomedicine market in South America. Innovations in nanomaterials and their applications in drug delivery, diagnostics, and imaging are expanding the potential of nanomedicine. For instance, the use of nanoparticles for targeted therapy has shown promising results in clinical trials, leading to increased investment in this area. The market for nanotechnology in healthcare is expected to grow at a CAGR of around 12% from 2025 to 2030. This growth is indicative of the rising interest in harnessing nanotechnology to improve patient outcomes, thus driving the demand for nanomedicine solutions across the region.

Supportive Government Initiatives

Government initiatives aimed at promoting healthcare innovation are playing a pivotal role in the development of the nanomedicine market in South America. Various countries in the region are implementing policies to support research and development in nanotechnology and its applications in medicine. For example, funding programs and grants are being established to encourage collaboration between academic institutions and industry players. These initiatives not only enhance the research landscape but also facilitate the commercialization of nanomedicine products. As a result, the supportive regulatory environment is expected to stimulate growth in the nanomedicine market, attracting investments and fostering innovation.

Growing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in South America is a significant driver for the nanomedicine market. Conditions such as cancer, diabetes, and cardiovascular diseases are becoming increasingly prevalent, necessitating innovative treatment approaches. The World Health Organization has reported that chronic diseases account for approximately 60% of all deaths in the region. This alarming statistic underscores the urgent need for effective therapies, which nanomedicine can provide through advanced drug delivery systems and targeted therapies. As healthcare providers seek to address these challenges, the adoption of nanomedicine solutions is likely to accelerate, thereby fostering growth in the market.

Increasing Demand for Personalized Medicine

The growing emphasis on personalized medicine in South America is driving the nanomedicine market. Patients and healthcare providers are increasingly seeking tailored treatment options that cater to individual genetic profiles and health conditions. This shift is evident as the market for personalized medicine is projected to reach approximately $2.5 billion by 2026 in the region. Nanomedicine plays a crucial role in this transformation, enabling the development of targeted drug delivery systems that enhance therapeutic efficacy while minimizing side effects. As healthcare systems evolve, the integration of nanotechnology into personalized treatment plans is likely to become more prevalent, thereby propelling the growth of the nanomedicine market in South America.