Growing Aging Population

The aging population in South America is a crucial driver for the medication management market. As individuals age, they often experience multiple chronic conditions, necessitating complex medication regimens. This demographic shift is projected to increase the demand for effective medication management solutions. By 2030, it is estimated that the population aged 60 and above will reach 25% in several South American countries. This trend indicates a growing need for systems that can help manage polypharmacy and reduce medication errors, thereby enhancing patient safety and adherence. The medication management market must adapt to these demographic changes by developing tailored solutions that cater to the unique needs of older adults.

Rising Healthcare Expenditure

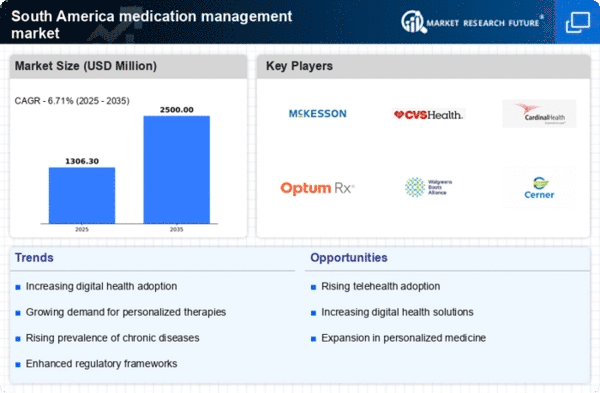

Rising healthcare expenditure in South America is a significant driver for the medication management market. Governments and private sectors are investing more in healthcare infrastructure, which includes medication management systems. In 2025, healthcare spending in the region is expected to reach approximately $1 trillion, reflecting a growth rate of around 6% annually. This increase in funding allows for the implementation of advanced medication management solutions that can enhance patient care and reduce costs associated with medication errors. The medication management market stands to benefit from this trend, as healthcare providers seek to optimize their resources and improve patient outcomes.

Regulatory Changes and Support

Regulatory changes and support for medication management practices are emerging as a key driver in South America. Governments are increasingly recognizing the importance of medication management in improving healthcare outcomes and are implementing policies to support its integration into healthcare systems. For example, new regulations may mandate the use of electronic prescribing and medication reconciliation processes. These changes are expected to enhance the efficiency and safety of medication management practices. As a result, the medication management market is likely to see growth as healthcare providers adapt to comply with these regulations, ultimately leading to better patient care.

Technological Advancements in Healthcare

Technological advancements are significantly influencing the medication management market in South America. Innovations such as electronic health records (EHRs), telemedicine, and mobile health applications are transforming how healthcare providers manage patient medications. These technologies facilitate better communication between patients and providers, leading to improved medication adherence and outcomes. For instance, the integration of EHRs with medication management systems can reduce prescription errors by up to 30%. As healthcare systems in South America increasingly adopt these technologies, the medication management market is likely to experience substantial growth, driven by the demand for more efficient and effective medication management solutions.

Increasing Awareness of Medication Safety

There is a growing awareness of medication safety among healthcare professionals and patients in South America, which is driving the medication management market. Initiatives aimed at educating both providers and patients about the risks associated with improper medication use are becoming more prevalent. This heightened awareness is likely to lead to increased demand for medication management solutions that ensure safe prescribing practices and adherence. Reports indicate that medication errors can lead to significant healthcare costs, estimated at $42 billion annually in the region. Consequently, the medication management market is positioned to expand as stakeholders prioritize safety and quality in medication use.