Aging Population

The demographic shift towards an aging population in South America is significantly influencing the medical ventilator market. As the population ages, the prevalence of chronic respiratory diseases, such as COPD and asthma, is expected to rise. By 2025, it is estimated that over 15% of the population will be aged 65 and older, leading to an increased demand for respiratory support devices. This demographic trend necessitates the availability of advanced medical ventilators to cater to the specific needs of elderly patients. The medical ventilator market is poised to expand as healthcare providers adapt to these demographic changes, ensuring that adequate resources are available for respiratory care.

Increasing Healthcare Expenditure

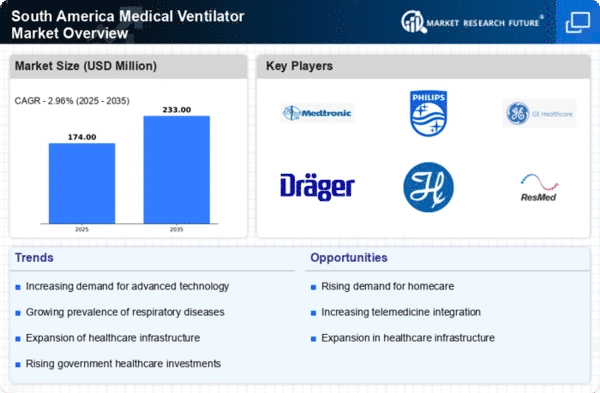

The rising healthcare expenditure in South America is a pivotal driver for the medical ventilator market. Governments and private sectors are allocating more funds towards healthcare infrastructure, which includes the procurement of advanced medical equipment. In 2025, healthcare spending in the region is projected to reach approximately $500 billion, reflecting a growth of around 8% annually. This increase in budget allows hospitals and healthcare facilities to invest in modern ventilators, enhancing patient care and treatment outcomes. Furthermore, as healthcare systems evolve, there is a growing emphasis on improving respiratory care, which further propels the demand for sophisticated ventilators. The medical ventilator market is likely to benefit from this trend, as more facilities seek to upgrade their equipment to meet the rising standards of care.

Government Initiatives and Funding

Government initiatives and funding aimed at improving healthcare infrastructure are crucial for the medical ventilator market. In South America, various governments are implementing programs to enhance healthcare access and quality, which includes financial support for medical equipment procurement. For instance, initiatives to provide funding for hospitals to acquire modern ventilators are becoming more common. By 2025, it is anticipated that government funding for medical equipment will increase by 12%, directly benefiting the medical ventilator market. This support not only facilitates the acquisition of necessary equipment but also encourages the development of local manufacturing capabilities, further strengthening the market.

Rising Awareness of Respiratory Health

There is a growing awareness of respiratory health issues among the South American population, which is driving the medical ventilator market. Public health campaigns and educational initiatives are increasingly focusing on the importance of respiratory health, leading to a higher demand for ventilatory support in both hospital and home settings. This heightened awareness is likely to result in a 10% increase in the utilization of medical ventilators by 2026. As patients and healthcare providers become more informed about the benefits of timely respiratory intervention, the medical ventilator market is expected to see a surge in demand for both invasive and non-invasive ventilators.

Technological Innovations in Ventilation

Technological innovations in ventilation systems are transforming the medical ventilator market. The introduction of smart ventilators equipped with advanced monitoring capabilities and artificial intelligence is enhancing patient outcomes and operational efficiency. In 2025, the market for smart ventilators is projected to grow by 15%, driven by the need for more precise and responsive respiratory support. These innovations not only improve the quality of care but also reduce the burden on healthcare professionals. The medical ventilator market is likely to experience significant growth as hospitals and clinics adopt these cutting-edge technologies to provide better patient care.