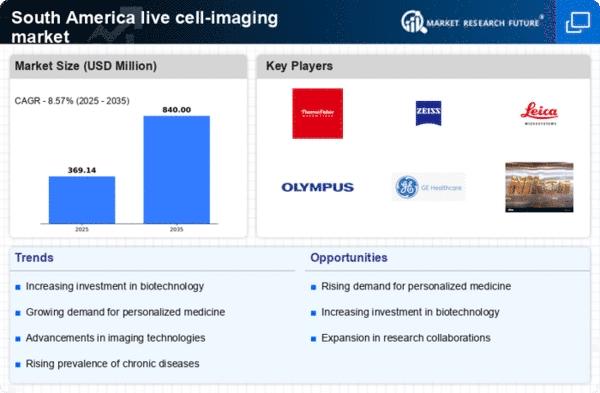

Advancements in Imaging Technologies

Technological innovations in imaging modalities are significantly influencing the live cell-imaging market in South America. The introduction of high-resolution imaging systems and novel fluorescent probes enhances the ability to visualize cellular dynamics with unprecedented clarity. These advancements not only improve the accuracy of research findings but also expand the applications of live cell imaging across various fields, including drug discovery and regenerative medicine. The market for imaging technologies is anticipated to grow at a CAGR of 8% through 2027, reflecting the increasing investment in research and development. As these technologies evolve, the live cell-imaging market is poised to benefit from enhanced capabilities and broader adoption in scientific research.

Rising Incidence of Chronic Diseases

The prevalence of chronic diseases in South America is escalating, which is likely to propel the live cell-imaging market. Conditions such as cancer, diabetes, and cardiovascular diseases are becoming increasingly common, necessitating advanced research methodologies to understand their underlying mechanisms. Live cell imaging provides critical insights into cellular behavior and disease progression, making it an invaluable tool for researchers and clinicians. According to recent statistics, chronic diseases account for over 70% of deaths in the region, highlighting the urgent need for innovative diagnostic and therapeutic approaches. As healthcare providers seek to improve patient outcomes, the live cell-imaging market is expected to grow in response to this pressing healthcare challenge.

Growing Demand for Personalized Medicine

The increasing focus on personalized medicine in South America is driving the live cell-imaging market. As healthcare systems shift towards tailored treatments, the need for advanced imaging techniques becomes paramount. Live cell imaging allows researchers to observe cellular processes in real-time, facilitating the development of personalized therapies. The market for personalized medicine in South America is projected to reach approximately $10 billion by 2026, indicating a robust growth trajectory. This trend underscores the importance of live cell-imaging technologies in understanding disease mechanisms and treatment responses, thereby enhancing the overall efficacy of personalized healthcare solutions. Consequently, the live cell-imaging market is likely to experience significant expansion as it aligns with the evolving demands of personalized medicine.

Government Initiatives Supporting Research

Government initiatives aimed at bolstering scientific research are playing a crucial role in the live cell-imaging market in South America. Increased funding for research projects and infrastructure development is enabling institutions to acquire advanced imaging technologies. These initiatives are designed to enhance the region's research capabilities, particularly in the life sciences. For instance, several South American countries have launched programs to support biotechnology research, which often relies on live cell imaging techniques. As a result, the live cell-imaging market is likely to benefit from these supportive policies, leading to increased investment and growth opportunities in the coming years.

Increased Academic and Industrial Collaborations

Collaborative efforts between academic institutions and industry players are fostering growth in the live cell-imaging market in South America. These partnerships facilitate knowledge exchange, resource sharing, and the development of innovative imaging solutions. By combining academic research with industrial expertise, the live cell-imaging market can accelerate the translation of scientific discoveries into practical applications. Such collaborations are becoming more prevalent, as evidenced by the establishment of joint research initiatives and funding programs aimed at advancing imaging technologies. This synergy is likely to enhance the competitiveness of the live cell-imaging market, driving further advancements and adoption across various sectors.