Growing Biopharmaceutical Sector

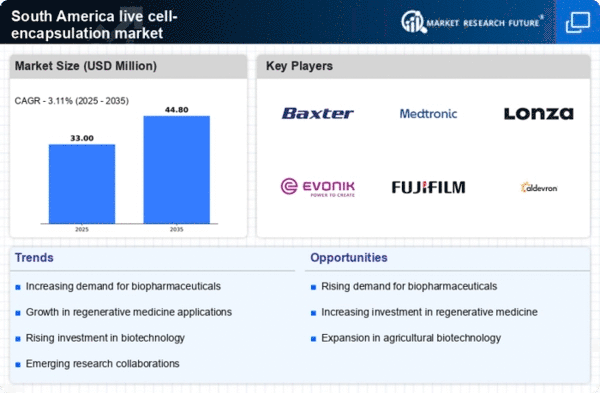

The biopharmaceutical sector in South America is experiencing notable growth, which appears to be a significant driver for the live cell-encapsulation market. With an increasing number of biopharmaceutical companies emerging, the demand for innovative drug delivery systems is on the rise. Live cell-encapsulation technologies are being recognized for their potential to enhance therapeutic efficacy and reduce side effects. In 2025, the biopharmaceutical market in South America is projected to reach approximately $30 billion, indicating a robust environment for live cell-encapsulation applications. This growth is likely to stimulate investments in research and development, further propelling advancements in encapsulation technologies. As biopharmaceuticals continue to gain traction, the live cell-encapsulation market is expected to benefit from the increasing need for effective delivery mechanisms.

Emerging Startups and Innovation Hubs

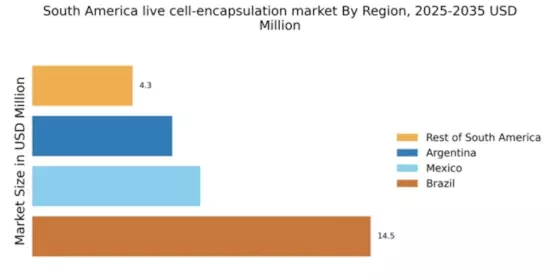

The emergence of startups and innovation hubs in South America is contributing to the dynamism of the live cell-encapsulation market. These startups are often at the forefront of technological advancements, developing novel encapsulation techniques and applications. The rise of innovation hubs, particularly in countries like Argentina and Chile, is fostering collaboration between entrepreneurs, researchers, and investors. This collaborative environment is likely to accelerate the development of new products and solutions in the live cell-encapsulation market. As these startups gain traction, they may attract funding and partnerships, further enhancing the competitive landscape. The innovative spirit within these hubs could lead to breakthroughs that significantly impact the live cell-encapsulation market in the coming years.

Increased Focus on Regenerative Medicine

The growing emphasis on regenerative medicine in South America is emerging as a key driver for the live cell-encapsulation market. Regenerative medicine aims to repair or replace damaged tissues and organs, and live cell-encapsulation technologies are being explored for their potential to deliver therapeutic cells effectively. As research institutions and universities invest in regenerative medicine initiatives, the demand for encapsulation solutions is likely to rise. In 2025, the regenerative medicine market in South America is anticipated to reach $5 billion, highlighting the potential for live cell-encapsulation applications in this field. This focus on regenerative therapies may encourage collaborations between academic institutions and industry players, fostering innovation and driving growth in the live cell-encapsulation market.

Growing Awareness of Cell-Based Therapies

There is a growing awareness of cell-based therapies among healthcare professionals and patients in South America, which appears to be driving interest in the live cell-encapsulation market. As more clinical studies demonstrate the efficacy of cell-based treatments, healthcare providers are increasingly considering these options for various conditions. This heightened awareness is likely to lead to greater demand for technologies that facilitate the safe and effective delivery of therapeutic cells. In 2025, the market for cell-based therapies in South America is projected to grow by 20%, indicating a robust interest in these innovative treatments. Consequently, the live cell-encapsulation market is expected to benefit from this trend, as encapsulation technologies play a crucial role in enhancing the viability and functionality of cell-based therapies.

Rising Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is on the rise, which may positively impact the live cell-encapsulation market. Governments and private entities are allocating substantial funds to enhance healthcare facilities, improve access to advanced medical technologies, and foster innovation. For instance, Brazil has committed to increasing its healthcare budget by 15% in 2025, which could lead to greater adoption of cutting-edge technologies, including live cell-encapsulation. This investment trend is likely to create a conducive environment for the development and commercialization of encapsulation solutions, as healthcare providers seek to integrate advanced therapies into their offerings. Consequently, the live cell-encapsulation market stands to gain from the enhanced healthcare landscape, which is expected to facilitate the introduction of novel therapeutic approaches.