Regulatory Landscape Changes

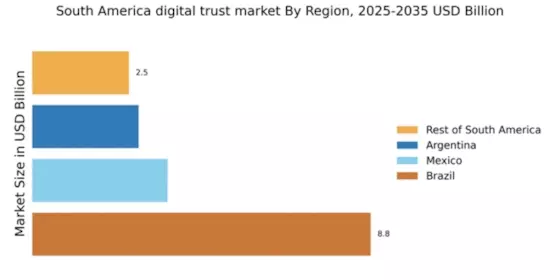

The regulatory landscape in South America is undergoing significant changes, which is shaping the digital trust market. Governments are increasingly recognizing the importance of data protection and privacy, leading to the introduction of stricter regulations. For instance, the implementation of the General Data Protection Law (LGPD) in Brazil has set a precedent for data governance across the region. Organizations are now compelled to align their practices with these regulations, which often require substantial investments in compliance technologies. As a result, the digital trust market is experiencing growth as companies seek solutions that facilitate adherence to legal requirements while ensuring the security of consumer data. This trend is likely to continue as more countries in South America adopt similar regulatory frameworks.

Growing Cybersecurity Threats

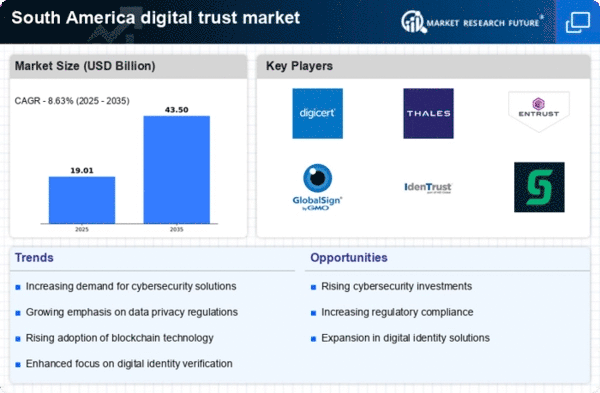

The digital trust market in South America is increasingly influenced by the rise in cybersecurity threats. As businesses and consumers become more reliant on digital platforms, the frequency and sophistication of cyberattacks have escalated. Reports indicate that cybercrime costs in the region could reach $90 billion annually by 2025. This alarming trend compels organizations to invest in robust cybersecurity measures, thereby driving demand for digital trust solutions. Companies are prioritizing the implementation of advanced security protocols and technologies to safeguard sensitive data. Consequently, the digital trust market is witnessing a surge in the adoption of identity verification, encryption, and fraud detection services, as stakeholders seek to enhance their security posture and maintain consumer confidence.

Evolving Consumer Expectations

In South America, consumer expectations regarding data privacy and security are evolving rapidly. As individuals become more informed about their digital rights, they demand greater transparency and control over their personal information. This shift in consumer behavior is significantly impacting the digital trust market. Businesses are now required to adopt practices that prioritize user privacy, such as clear data usage policies and consent mechanisms. A recent survey revealed that 70% of consumers in the region are more likely to engage with companies that demonstrate a commitment to data protection. This growing expectation drives organizations to invest in digital trust solutions that not only comply with regulations but also foster customer loyalty and trust.

Digital Transformation Initiatives

Digital transformation initiatives across various sectors in South America are driving the growth of the digital trust market. As organizations embrace digital technologies to enhance operational efficiency and customer engagement, the need for secure and trustworthy digital environments becomes paramount. Investments in cloud computing, e-commerce, and mobile applications are on the rise, with projections indicating a 25% increase in digital spending by 2026. This transformation necessitates the integration of digital trust solutions to protect sensitive information and build consumer confidence. Companies are increasingly adopting identity management, secure payment systems, and data encryption technologies to ensure a seamless and secure digital experience for their customers.

Increased Investment in Digital Infrastructure

The digital trust market in South America is benefiting from increased investment in digital infrastructure. Governments and private sectors are recognizing the necessity of robust digital frameworks to support economic growth and innovation. Initiatives aimed at enhancing internet connectivity and expanding access to digital services are underway, with an estimated investment of $30 billion projected for the next five years. This investment is likely to create a more secure digital environment, fostering trust among users. As infrastructure improves, the demand for digital trust solutions, such as secure communication channels and data protection services, is expected to rise. Consequently, the digital trust market is poised for growth as stakeholders seek to capitalize on the opportunities presented by enhanced digital infrastructure.