Supportive Government Policies

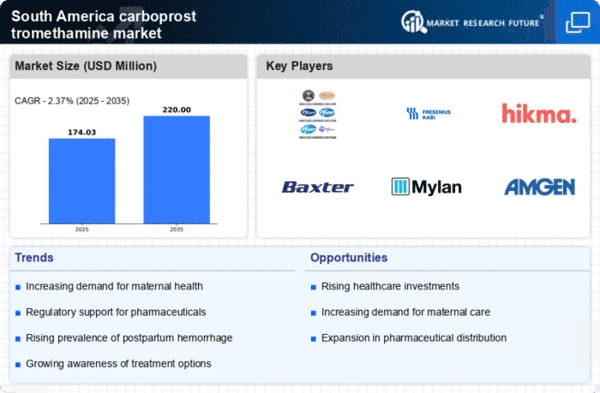

Supportive government policies aimed at improving maternal health are emerging as a key driver for the carboprost tromethamine market. Various South American governments are implementing policies that promote access to essential medications and maternal healthcare services. For example, initiatives to subsidize the cost of critical drugs have been introduced, making medications like carboprost tromethamine more accessible to healthcare providers and patients. In 2023, government spending on maternal health programs increased by approximately 10%, reflecting a commitment to reducing maternal mortality rates. This supportive environment is likely to enhance the carboprost tromethamine market, as healthcare systems are encouraged to adopt effective treatments for managing postpartum complications.

Advancements in Healthcare Infrastructure

The ongoing improvements in healthcare infrastructure across South America are expected to bolster the carboprost tromethamine market. Enhanced healthcare facilities, increased access to medical services, and the establishment of specialized maternal health units contribute to a more robust healthcare environment. For instance, investments in hospitals and clinics have risen by approximately 15% in the last few years, facilitating better access to essential medications like carboprost tromethamine. As healthcare providers become more equipped to handle complex maternal health issues, the demand for effective treatments is likely to rise, thereby positively impacting the carboprost tromethamine market. This trend indicates a shift towards prioritizing maternal health, which could lead to increased utilization of this medication.

Rising Prevalence of Postpartum Hemorrhage

The increasing incidence of postpartum hemorrhage (PPH) in South America is a critical driver for the carboprost tromethamine market. PPH is a leading cause of maternal mortality, and its prevalence has been rising due to various factors, including inadequate prenatal care and rising cesarean section rates. As healthcare providers seek effective solutions to manage PPH, the demand for carboprost tromethamine is likely to grow. In 2023, it was estimated that PPH affected approximately 6-10% of deliveries in the region, highlighting the urgent need for effective treatment options. This trend suggests that the carboprost tromethamine market will experience significant growth as healthcare systems prioritize maternal health and invest in effective medications to reduce mortality rates associated with PPH.

Growing Awareness of Maternal Health Issues

There is a notable increase in awareness regarding maternal health issues in South America, which serves as a significant driver for the carboprost tromethamine market. Educational campaigns and community outreach programs have been instrumental in informing the public about the risks associated with childbirth, including postpartum hemorrhage. This heightened awareness has led to a greater demand for effective treatment options, including carboprost tromethamine. Reports indicate that maternal health awareness initiatives have increased by over 20% in recent years, resulting in more women seeking medical care during and after pregnancy. Consequently, the carboprost tromethamine market is likely to benefit from this trend as healthcare providers respond to the growing need for effective interventions.

Increasing Investment in Pharmaceutical Research

The rising investment in pharmaceutical research and development within South America is poised to drive the carboprost tromethamine market. As pharmaceutical companies focus on developing innovative solutions for maternal health, the demand for established medications like carboprost tromethamine is expected to grow. In recent years, R&D spending in the pharmaceutical sector has increased by around 12%, indicating a strong commitment to addressing maternal health challenges. This investment not only supports the development of new formulations but also enhances the availability of existing medications. Consequently, the carboprost tromethamine market is likely to benefit from this trend, as more resources are allocated to improving maternal health outcomes.