Government Support and Incentives

Government initiatives in South America are playing a crucial role in fostering the growth of the carbon composites market. Various countries are implementing policies aimed at promoting the use of advanced materials in manufacturing processes. For instance, Brazil has introduced tax incentives for companies investing in research and development of carbon composite technologies. This support is expected to stimulate innovation and increase production capabilities within the region. Additionally, public-private partnerships are emerging, facilitating collaboration between government entities and private firms to enhance the development of carbon composites. Such initiatives may lead to a projected market growth rate of 6% annually, as stakeholders recognize the potential of carbon composites to drive economic growth and technological advancement.

Expansion of Renewable Energy Sector

The carbon composites market in South America is likely to benefit from the expansion of the renewable energy sector, particularly in wind energy applications. Wind turbine manufacturers are increasingly utilizing carbon composites for blades due to their superior strength-to-weight ratio and resistance to environmental degradation. In 2025, the wind energy capacity in South America is expected to reach 30 GW, representing a growth of 15% from previous years. This increase in capacity is anticipated to drive demand for carbon composites, as manufacturers seek materials that enhance the efficiency and longevity of wind turbines. The integration of carbon composites in renewable energy infrastructure aligns with broader sustainability goals, further solidifying their role in the market.

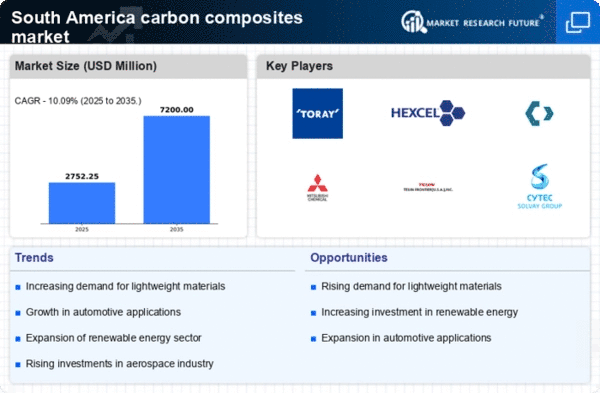

Rising Demand for Lightweight Materials

The carbon composites market in South America is experiencing a notable surge in demand for lightweight materials, particularly in the aerospace and automotive sectors. As manufacturers seek to enhance fuel efficiency and reduce emissions, the adoption of carbon composites is becoming increasingly prevalent. In 2025, the aerospace industry in South America is projected to grow by approximately 5.2%, driving the need for advanced materials that can withstand high stress while remaining lightweight. This trend is likely to propel the carbon composites market forward, as companies prioritize materials that contribute to overall performance and sustainability. Furthermore, the automotive sector's shift towards electric vehicles, which require lighter components for improved range, further underscores the importance of carbon composites in meeting these evolving industry standards.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are significantly influencing the carbon composites market in South America. Innovations such as automated fiber placement and 3D printing are enhancing the efficiency and precision of carbon composite production. These technologies not only reduce production costs but also enable the creation of complex geometries that were previously unattainable. As a result, manufacturers are likely to see a reduction in waste and an increase in product performance. The adoption of these advanced manufacturing techniques is projected to contribute to a market growth rate of approximately 7% over the next few years, as companies strive to remain competitive in an evolving landscape. This trend underscores the importance of continuous innovation in driving the carbon composites market forward.

Increasing Applications in Sports and Recreation

The carbon composites market in South America is witnessing a growing interest in applications within the sports and recreation sectors. High-performance sporting goods, such as bicycles, tennis rackets, and fishing rods, are increasingly being manufactured using carbon composites due to their lightweight and durable properties. The sports equipment market in South America is projected to grow by 8% annually, with carbon composites playing a pivotal role in enhancing product performance. As athletes and consumers alike seek equipment that offers superior strength and reduced weight, manufacturers are likely to invest more in carbon composite technologies. This trend not only reflects changing consumer preferences but also highlights the versatility of carbon composites across various industries.

Leave a Comment