Rising Healthcare Expenditure

Rising healthcare expenditure in South America is a notable driver for the arachnoiditis market. Governments and private sectors are increasingly allocating funds to improve healthcare infrastructure and access to treatments. Recent reports indicate that healthcare spending in the region has increased by approximately 10% annually, reflecting a commitment to enhancing patient care. This increase in expenditure is likely to facilitate the availability of advanced treatment options for arachnoiditis, as well as improve access to specialized healthcare services. As more resources are directed towards managing chronic conditions like arachnoiditis, the market is expected to experience growth, driven by the demand for effective therapies and comprehensive care.

Enhanced Diagnostic Capabilities

Enhanced diagnostic capabilities are emerging as a key driver for the arachnoiditis market in South America. Advances in imaging technologies, such as MRI and CT scans, have significantly improved the ability to diagnose arachnoiditis accurately. These advancements allow for earlier detection and intervention, which is crucial for managing the condition effectively. As diagnostic tools become more accessible and affordable, healthcare providers are better equipped to identify arachnoiditis cases, leading to increased patient referrals and treatment initiation. The growing emphasis on accurate diagnosis is likely to contribute to the expansion of the arachnoiditis market, as more patients receive timely and appropriate care.

Increasing Incidence of Arachnoiditis

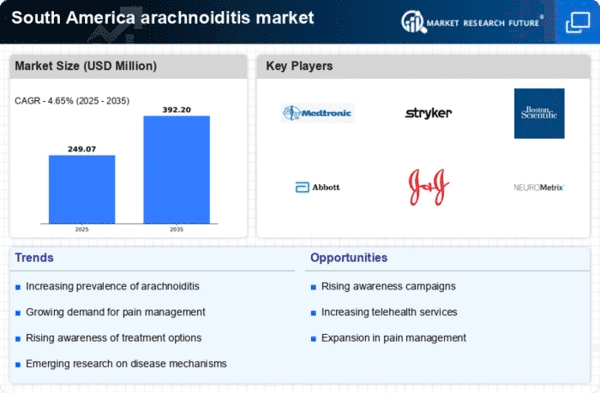

The rising incidence of arachnoiditis in South America is a critical driver for the arachnoiditis market. Recent studies indicate that the prevalence of this condition is increasing, with estimates suggesting that it affects approximately 1 in 1,000 individuals in the region. This growing patient population necessitates enhanced healthcare services and treatment options, thereby stimulating market growth. The increasing number of cases is attributed to various factors, including the rising use of spinal surgeries and epidural injections, which are known risk factors for developing arachnoiditis. As awareness of the condition grows among healthcare professionals and patients alike, the demand for effective therapies and management strategies is likely to escalate, further propelling the arachnoiditis market in South America.

Investment in Research and Development

Investment in research and development (R&D) is a significant driver for the arachnoiditis market in South America. Pharmaceutical companies and research institutions are increasingly focusing on developing innovative treatment options for arachnoiditis, which has historically been under-researched. The South American market has seen a surge in funding, with R&D expenditures reaching approximately $500 million in recent years. This investment is aimed at discovering new therapeutic agents and improving existing treatment modalities. Furthermore, collaborations between academic institutions and industry players are fostering innovation, which may lead to breakthroughs in the management of arachnoiditis. As new therapies emerge, they are expected to enhance patient outcomes and expand the market, making R&D a pivotal factor in the growth of the arachnoiditis market.

Growing Demand for Pain Management Solutions

The increasing demand for effective pain management solutions is driving the arachnoiditis market in South America. Patients suffering from arachnoiditis often experience chronic pain, which can severely impact their quality of life. As awareness of the condition grows, so does the need for effective pain relief options. The market for pain management therapies is projected to grow at a CAGR of 7% over the next five years, indicating a robust demand for innovative solutions. This trend is prompting healthcare providers to seek out advanced treatment modalities, including pharmacological and non-pharmacological approaches. The focus on improving patient quality of life through effective pain management is likely to stimulate the arachnoiditis market, as more patients seek specialized care and treatment.