Government Initiatives and Support

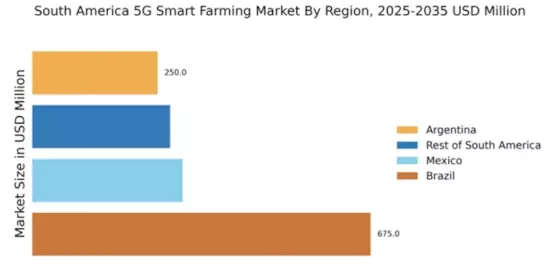

Government initiatives in South America are significantly influencing the 5g smart-farming market. Various national and regional policies are being implemented to promote technological advancements in agriculture, including the integration of 5g networks. These initiatives often include financial incentives, grants, and subsidies aimed at encouraging farmers to adopt modern technologies. For instance, Brazil's government has allocated approximately $200 million to support agricultural innovation, which includes the deployment of 5g infrastructure. Such support not only enhances connectivity but also fosters collaboration among stakeholders, ultimately driving the growth of the 5g smart-farming market in the region.

Rising Demand for Sustainable Agriculture

The 5g smart-farming market in South America is experiencing a notable surge in demand for sustainable agricultural practices. Farmers are increasingly recognizing the importance of environmentally friendly methods to enhance productivity while minimizing ecological impact. This shift is driven by consumer preferences for organic and sustainably sourced products, which are gaining traction in both local and international markets. As a result, the adoption of 5g technology facilitates precision farming techniques, enabling farmers to optimize resource usage, reduce waste, and improve crop yields. Reports indicate that the market for sustainable agriculture in South America is projected to grow at a CAGR of 10% over the next five years, highlighting the potential for 5g smart-farming solutions to play a pivotal role in this transformation.

Technological Advancements in Agriculture

Technological advancements are reshaping the agricultural landscape in South America, thereby propelling the 5g smart-farming market. Innovations such as drones, autonomous tractors, and advanced sensors are becoming increasingly prevalent, allowing farmers to monitor crops and manage resources more effectively. The integration of 5g technology enhances these innovations by providing faster data transmission and real-time analytics, which are crucial for decision-making. It is estimated that the adoption of these technologies could lead to a 20% increase in crop yields, underscoring the potential impact of 5g smart-farming solutions on agricultural productivity in the region.

Growing Investment in Agricultural Technology

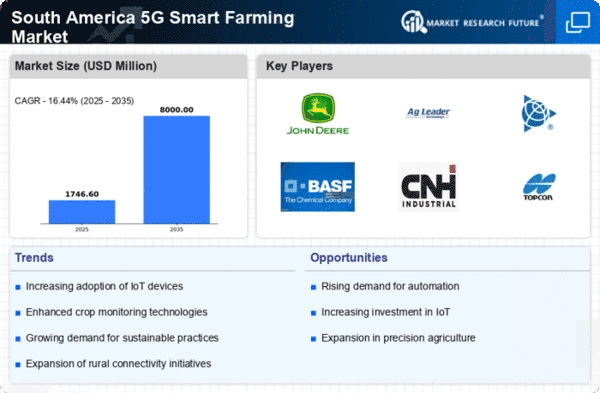

Investment in agricultural technology is on the rise in South America, significantly impacting the 5g smart-farming market. Venture capital and private equity firms are increasingly directing funds towards agri-tech startups that focus on innovative solutions, including those leveraging 5g technology. In 2025, investments in agri-tech in South America are projected to reach $1 billion, reflecting a growing recognition of the importance of technology in enhancing agricultural efficiency. This influx of capital not only supports the development of new technologies but also encourages collaboration among various stakeholders, further driving the growth of the 5g smart-farming market.

Increasing Connectivity and Infrastructure Development

The expansion of connectivity and infrastructure in South America is a crucial driver for the 5g smart-farming market. As rural areas gain access to high-speed internet and improved telecommunications infrastructure, farmers are better positioned to adopt advanced technologies. The rollout of 5g networks is expected to enhance connectivity in remote agricultural regions, enabling farmers to utilize smart farming solutions effectively. Reports suggest that by 2026, over 70% of rural areas in South America will have access to 5g networks, which could significantly transform agricultural practices and boost the adoption of 5g smart-farming technologies.