- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

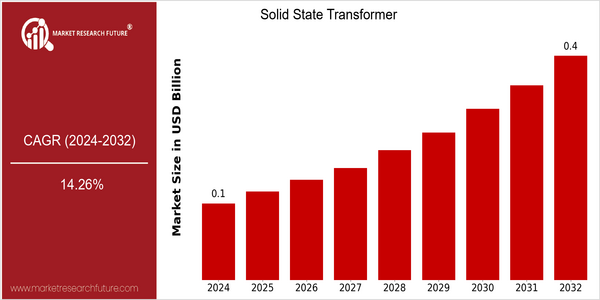

| Year | Value |

|---|---|

| 2024 | USD 0.13 Billion |

| 2032 | USD 0.37 Billion |

| CAGR (2024-2032) | 14.26 % |

Note – Market size depicts the revenue generated over the financial year

The Solid State Transformer (SST) market is poised for significant growth, with the current market size estimated at USD 0.13 billion in 2024 and projected to reach USD 0.37 billion by 2032. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 14.26% over the forecast period. The increasing demand for efficient power management solutions, coupled with the rising adoption of renewable energy sources, is driving the expansion of the SST market. As traditional transformers face limitations in terms of efficiency and adaptability, solid state transformers offer enhanced performance, including improved energy conversion and integration capabilities with smart grid technologies. Key technological trends, such as advancements in semiconductor materials and power electronics, are further propelling the market forward. Companies like Siemens, ABB, and General Electric are at the forefront of innovation in this space, actively engaging in strategic initiatives such as partnerships and product launches to enhance their market presence. For instance, Siemens has been investing in research and development to optimize SST designs, while ABB has focused on integrating SSTs into their existing energy solutions portfolio. These efforts not only highlight the competitive landscape but also underscore the transformative potential of solid state transformers in modern energy systems.

Regional Market Size

Regional Deep Dive

The Solid State Transformer (SST) market is experiencing significant growth across various regions, driven by the increasing demand for efficient power management solutions and the transition towards renewable energy sources. In North America, the market is characterized by advanced technological infrastructure and a strong focus on smart grid initiatives, while Europe is leading in regulatory support for sustainable energy solutions. The Asia-Pacific region is witnessing rapid industrialization and urbanization, which is propelling the demand for SSTs in power distribution. The Middle East and Africa are gradually adopting SST technology, influenced by the need for reliable energy solutions in emerging economies. Latin America is also exploring SSTs to enhance grid stability and integrate renewable energy sources, reflecting a growing awareness of energy efficiency.

Europe

- The European Union's Green Deal is pushing for the adoption of solid-state transformers to facilitate the transition to a carbon-neutral economy, with specific funding allocated for related projects.

- Leading companies such as ABB and Schneider Electric are collaborating on projects that integrate SSTs with renewable energy sources, enhancing grid flexibility and stability.

Asia Pacific

- China's rapid urbanization and industrial growth are driving the demand for solid-state transformers, with state-owned enterprises investing in advanced power distribution technologies.

- Japan is focusing on SSTs as part of its energy transition strategy, particularly in integrating renewable energy into its grid, supported by government incentives.

Latin America

- Brazil is implementing solid-state transformers in its energy infrastructure to improve grid stability and support the integration of renewable energy sources.

- Governments in Latin America are increasingly recognizing the importance of SSTs in achieving energy efficiency goals, leading to partnerships with technology providers.

North America

- The U.S. Department of Energy has launched initiatives to promote the integration of solid-state transformers in smart grid applications, enhancing energy efficiency and reliability.

- Companies like General Electric and Siemens are investing heavily in R&D for SST technology, focusing on innovations that improve performance and reduce costs.

Middle East And Africa

- The UAE is investing in solid-state transformer technology as part of its Vision 2021 initiative, aiming to enhance energy efficiency and sustainability in its power sector.

- Countries like South Africa are exploring SSTs to improve grid reliability and support renewable energy integration, driven by regulatory frameworks promoting clean energy.

Did You Know?

“Solid-state transformers can operate at higher frequencies than traditional transformers, allowing for more compact designs and improved efficiency.” — International Energy Agency (IEA)

Segmental Market Size

The Solid State Transformer (SST) segment plays a crucial role in the evolution of power distribution systems, currently experiencing significant growth driven by the increasing demand for efficient energy management and integration of renewable energy sources. Key factors propelling this demand include the need for enhanced grid reliability and the transition towards smart grid technologies, which necessitate advanced power conversion solutions. Regulatory policies promoting renewable energy adoption further stimulate interest in SSTs, as they facilitate the integration of distributed energy resources. Currently, the adoption of SST technology is in the scaled deployment phase, with notable projects in regions like Europe and North America. Companies such as Siemens and ABB are leading the charge, implementing SSTs in various applications, including electric vehicle charging stations and renewable energy integration. The primary use cases for SSTs encompass grid modernization, energy storage systems, and microgrid applications. Macro trends such as sustainability initiatives and government mandates for carbon reduction are accelerating the growth of this segment, while advancements in semiconductor technologies and digital control systems are shaping its evolution, enhancing efficiency and performance.

Future Outlook

The Solid State Transformer (SST) market is poised for significant growth from 2024 to 2032, with the market value projected to increase from $0.13 billion to $0.37 billion, reflecting a robust compound annual growth rate (CAGR) of 14.26%. This growth trajectory is driven by the increasing demand for efficient power conversion technologies in renewable energy systems, electric vehicles, and smart grid applications. As global energy policies increasingly favor decarbonization and the integration of renewable sources, the adoption of SSTs is expected to rise, enhancing grid reliability and efficiency. Key technological advancements, such as improvements in semiconductor materials and power electronics, are anticipated to further propel the SST market. Innovations in wide-bandgap semiconductors, like silicon carbide (SiC) and gallium nitride (GaN), are expected to enhance the performance and efficiency of SSTs, making them more attractive for utility and industrial applications. Additionally, the growing trend towards electrification and digitalization in various sectors will likely increase the penetration of SSTs, with usage rates projected to reach approximately 25% in new energy infrastructure projects by 2032. As stakeholders prioritize sustainable energy solutions, the SST market is set to become a critical component of future energy systems, aligning with global efforts to achieve net-zero emissions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 0.1 Billion |

| Market Size Value In 2023 | USD 0.11 Billion |

| Growth Rate | 15.80% (2023-2032) |

Solid State Transformer Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.