Software Quality Assurance Size

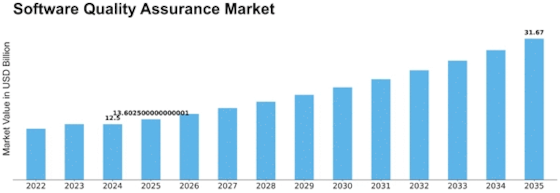

Software Quality Assurance Market Growth Projections and Opportunities

Various market dynamics and growth factors promote the behavior of organizations in terms of Software Quality Assurance (SQA) transformation. Until my last knowledge update, these factors continue to inform the role that they play in shaping the SQA market. One of the most groundbreaking factors affecting demand for strong SQA services is an increase in software applications complexity. Modern software is complex with many functionalities, integrations, and dependencies. Hence, organizations understand the need for comprehensive quality assurance processes to help them find and eliminate potential defects for software applications that deliver dependable performance with good user satisfaction.

On the one hand, software is so complicated nowadays that it fuels a sustained need for SQA solutions capable of navigating and verifying complex application environments. One critical factor influencing the SQA landscape is increasing adoption of Agile and DevOps methodologies. By encouraging continuous integration, constant delivery, and development-operations teamwork; Agile and DevOps have changed software framework by: This change of nature requires SQA processes that flow smoothly with the Agile and DevOps iterative collaborations. Organizations require SQA solutions that will be capable of evolving with the increased velocity, to ensure proper testing in line with fast delivery of software updates and features.

Delivery of products to market in as little time as possible drives the SQA. Within such a competitive business setting, organizations try to roll out quality software products as soon as possible to satisfy market needs and emerge victorious. SQA procedures that promote fast and effective testing like test automation, continuous testing pipelines become critical market drivers. The strategic need for the organizations across different industries is to limit testing timelines and ensure high quality.

The market factors of the SQA market depend on security considerations. As cybersecurity threats continue to grow in their frequency and complexity, organizations are focusing on identifying as well as neutralization of security weaknesses during the software development cycle. SQA practices should correspond with security testing approaches to ensure that the software applications are strongly secured against potential hacks. In the face of cybersecurity threats, security testing continues to be a prevalent market driver. In some industries regulatory compliance is of utmost importance and plays an important role in providing demands for SQA services. Sectors like health, finance and aviation are strictly regulated by rules and regulations.

Leave a Comment