Emerging E-commerce Sector

The rapid growth of the e-commerce sector in Russia is a significant driver for the ups battery market. With online retail sales projected to reach $30 billion by 2025, the need for reliable logistics and uninterrupted power supply is paramount. E-commerce businesses require efficient warehousing and distribution systems, which rely heavily on technology and power. The ups battery market is expected to benefit from this growth, as companies seek to ensure that their operations remain uninterrupted during power outages. This trend indicates a potential increase in demand for robust ups systems tailored to the logistics and e-commerce sectors.

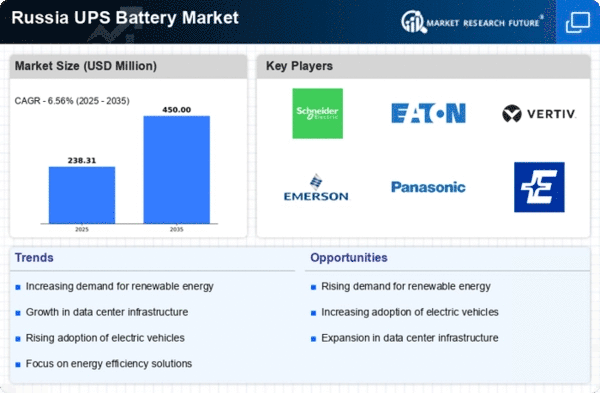

Growing Data Center Infrastructure

The expansion of data centers in Russia is a pivotal driver for the ups battery market. As businesses increasingly rely on digital operations, the demand for uninterrupted power supply becomes critical. In 2025, the data center market in Russia is projected to reach approximately $3 billion, indicating a robust growth trajectory. This surge necessitates reliable power solutions, thereby propelling the ups battery market. The need for energy-efficient and high-capacity batteries is paramount, as data centers require substantial power to maintain operations. Consequently, the ups battery market is likely to witness increased investments in advanced battery technologies to meet these demands.

Increased Focus on Industrial Automation

The trend towards industrial automation in Russia is driving the ups battery market. As industries adopt automated systems to enhance efficiency, the reliance on uninterrupted power supply becomes critical. In 2025, the industrial automation market in Russia is anticipated to grow by approximately 15%, further emphasizing the need for reliable power solutions. The ups battery market is likely to see increased demand for high-performance batteries that can support automated processes without interruption. This trend suggests a growing market for advanced ups systems that can cater to the specific needs of automated industrial environments.

Rising Adoption of Renewable Energy Sources

The transition towards renewable energy sources in Russia is influencing the ups battery market significantly. As the government promotes solar and wind energy, the need for energy storage solutions becomes essential. In 2025, renewable energy is expected to account for around 20% of the total energy mix in Russia. This shift necessitates the integration of ups systems to ensure a stable power supply, particularly during peak demand periods. The ups battery market is thus positioned to benefit from this trend, as businesses and households seek reliable backup power solutions to complement their renewable energy installations.

Government Initiatives for Infrastructure Development

Government initiatives aimed at enhancing infrastructure in Russia are likely to bolster the ups battery market. Investments in transportation, telecommunications, and energy sectors are expected to increase significantly, with a projected budget of over $50 billion for infrastructure projects by 2025. These developments necessitate reliable power solutions to support new facilities and technologies. The ups battery market stands to gain from these initiatives, as the demand for uninterrupted power supply becomes critical in newly developed infrastructure. This trend suggests a favorable environment for ups battery manufacturers to expand their market presence.