Rising Energy Demand in Urban Areas

Urbanization in Russia has led to a significant increase in energy demand, which is a crucial driver for the distributed energy-resource-management market. As cities expand, the need for efficient energy distribution and management becomes paramount. The urban population is projected to reach 85% by 2030, intensifying the pressure on existing energy infrastructure. This scenario necessitates the integration of distributed energy resources to ensure reliable energy supply. Consequently, the distributed energy-resource-management market is expected to grow as urban planners and energy providers seek innovative solutions to meet the rising demand.

Decentralization of Energy Production

The trend towards decentralization in energy production is a pivotal driver for the distributed energy-resource-management market in Russia. This shift allows for localized energy generation, reducing reliance on centralized power plants. The increasing installation of small-scale renewable energy systems, such as solar panels and wind turbines, supports this decentralization. It is estimated that by 2025, decentralized energy systems could account for up to 20% of the total energy generation capacity in Russia. This transition not only enhances energy security but also promotes resilience in the energy supply chain, thereby fostering growth in the distributed energy-resource-management market.

Government Incentives for Renewable Energy

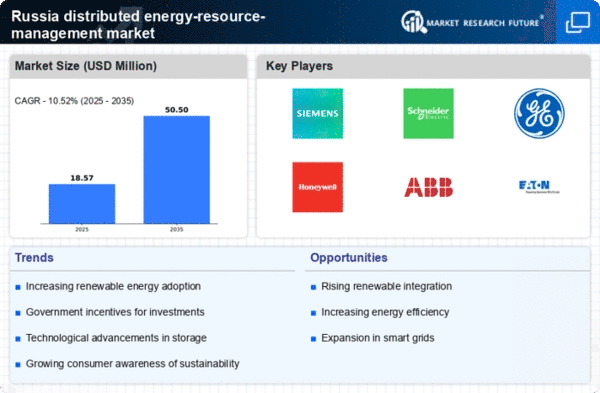

The Russian government has implemented various incentives to promote the adoption of renewable energy sources, which directly impacts the distributed energy-resource-management market. These incentives include tax breaks, subsidies, and grants aimed at both consumers and businesses. For instance, the government has set a target to increase the share of renewable energy in the energy mix to 4.5% by 2024. This push not only encourages investment in renewable technologies but also fosters the development of distributed energy systems. As a result, the distributed energy-resource-management market is likely to experience growth as more entities seek to capitalize on these financial benefits.

Environmental Regulations and Sustainability Goals

Russia's commitment to environmental sustainability is shaping the distributed energy-resource-management market. Stricter environmental regulations are being introduced to reduce carbon emissions and promote cleaner energy sources. The government aims to decrease greenhouse gas emissions by 30% by 2030 compared to 1990 levels. This regulatory framework encourages the adoption of distributed energy resources, as they often provide cleaner alternatives to traditional energy sources. As organizations strive to comply with these regulations, the distributed energy-resource-management market is expected to expand, driven by the need for sustainable energy solutions.

Technological Advancements in Energy Management Systems

Technological innovations in energy management systems are transforming the distributed energy-resource-management market in Russia. The emergence of advanced software solutions and IoT devices enables real-time monitoring and optimization of energy consumption. These technologies facilitate better integration of distributed energy resources, enhancing overall efficiency. The market for energy management systems is anticipated to grow at a CAGR of 15% from 2025 to 2030, indicating a robust demand for sophisticated energy solutions. As businesses and consumers increasingly adopt these technologies, the distributed energy-resource-management market is likely to benefit from enhanced operational capabilities.