- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

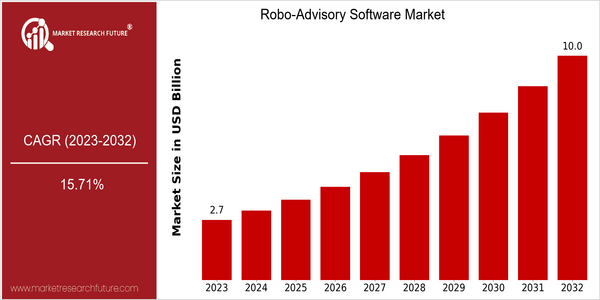

Robo Advisory Software Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 2.69 Billion |

| 2032 | USD 10.0 Billion |

| CAGR (2024-2032) | 15.71 % |

Note – Market size depicts the revenue generated over the financial year

The robo-advice market is estimated to be worth $2.69 billion in 2023 and is expected to reach a value of $10.00 billion by 2032, exhibiting a robust CAGR of 15.71% from 2024 to 2032. The high growth rate is mainly due to the growing demand for cost-effective and efficient financial tools. Since more and more investors seek personal advice without paying high fees to financial advisors, the use of robo-advice platforms is expected to increase further. There are several factors that drive this market expansion, such as the development of artificial intelligence and machine learning, which enhances the robo-advisor's ability to provide tailored investment advice. Also, the growing trend towards digitalization in the financial sector and the increasing penetration of mobile phones and the Internet are expected to facilitate the use of these platforms. The major players, such as Betterment, Wealthfront and Charles Schwab, are investing in technology and forming strategic alliances to enhance their service offerings. For example, the recent alliances between fintech companies and traditional financial institutions aim to integrate robo-advice into the wider financial system, which will also drive market growth.

Regional Deep Dive

The Robo-Advice Software Market is growing at a substantial pace across various regions, owing to the growing demand for investment solutions and the rising digitalization of financial services. North America is characterized by the high concentration of fintech companies and the technologically advanced population. On the other hand, Europe is characterized by the regulatory support to digital investment platforms. Asia-Pacific is the fastest-growing region in the market, owing to the rising middle class and the rising smartphone penetration. The Middle East and Africa is gradually adopting robo-advice services, owing to the diversification of economies, while Latin America is embracing robo-advice technology, owing to the rising financial literacy.

North America

- The United States SEC has introduced new guidelines which are expected to promote the use of robo-advisors and thus increase the level of confidence and participation of the general public in the stock exchange.

- Betterment and Wealthfront, the big players, are pushing the envelope with their artificial intelligence-based investment strategies.

- A growing trend towards ESG (Environmental, Social and Governance) investing is bringing robo-advisers into line with the demand for sustainable investment and bringing them closer to socially responsible investors.

Europe

- In Europe, the second version of the MiFID directive has led financial institutions to adopt robo-advisory services to increase transparency and improve the protection of investors.

- In the United Kingdom, Scalable Capital and Nutmeg are the pioneers of this new way of investing, offering a wide range of investment solutions.

- The growing popularity of mobile banking is driving the demand for integrated robo-advisory services, especially among millennials and generation Z investors.

Asia-Pacific

- In recent years, China's financial technology industry has developed rapidly. For example, Ant Financial's digital wealth management platform has been launched to serve the growing wealth of the people.

- Regulatory bodies in Australia are encouraging digital financial advice, thereby increasing competition between local and foreign robo-advisers.

- A second important factor is the rise of digital wallets and mobile payment platforms. In urban areas where there is a high penetration of mobile phones, robo-advice services are gaining ground, particularly in areas where there is a high proportion of digital wallets.

MEA

- The UAE is positioning itself as a financial technology hub, with initiatives such as the sandbox of the Dubai Financial Services Authority, which enables the development of robo-advisory platforms.

- The new financial services industry in the Gulf is developing rapidly, thanks to the emergence of local firms like Sarwa, which offer low-cost investment solutions tailored to the needs of the young, tech-savvy population.

- Saudi Arabia, for example, is making an effort to diversify its economy and is thus in a position to invest more in digital assets, as the viability of traditional investment avenues declines.

Latin America

- Brazil is seeing a boom in financial technology companies. Firms such as Magnetis and Warren are leading the way in delivering robo-advisory services to a previously underserved market.

- In Mexico, regulatory changes are creating a more favourable environment for digital investment platforms, which will encourage innovation and competition.

- The growing emphasis on financial education is also helping to raise awareness of robo-advisory services, particularly among younger investors.

Did You Know?

“By 2023, robo-advisors have managed more than $1trn in assets worldwide, indicating the increasing acceptance of automated investment solutions by the public.” — Statista

Segmental Market Size

The robo-adviser market is growing at a rapid rate, driven by the growing demand for automated investment solutions. This market plays a vital role in democratizing access to financial services, especially for young and tech-savvy investors who are looking for inexpensive and efficient solutions. The market is being driven by the rising demand for a personal financial advice, the support from regulators for the digitalization of financial services and the advancement of artificial intelligence, which improves the user experience and the investment management capabilities.

In North America, Betterment and Wealthfront are the most prominent players, while in Europe and Asia, the regulatory environment is conducive to the development of this industry. The most important applications are wealth management, retirement planning and tax optimization. Robo-advisors are used to optimize the cost of operations and optimize the use of resources. In addition, the development of sustainable investment and the impact of the epidemic of cholera are driving the development of this industry, as more and more people are turning to digital solutions for their financial needs. Machine learning and big data are also important for the development of this industry, and they are expected to help develop more sophisticated investment strategies and more convenient customer service.

Future Outlook

The Robo-Advice Software Market is expected to grow at a significant CAGR of 15.71% from 2023 to 2032. The growth of the market is mainly due to the growing demand for robo-advice among individual and institutional investors, who are looking for cost-effective and efficient portfolio management solutions. The robo-advice industry is expected to manage about 10% of the world's investable assets by 2032, up from about 2% in 2023, indicating a major shift in investment behavior towards digital platforms.

Artificial intelligence and machine learning are expected to make robo-advisory platforms more capable of analyzing risks and advising on investment strategies. Furthermore, the regulatory support for digital financial services is expected to stimulate the market, as governments and financial authorities recognize the potential of robo-advisors to increase access to investment opportunities. Emerging trends, such as the integration of ESG (Environmental, Social and Governance) criteria into investment algorithms, will further increase the appeal of the market to socially conscious investors, thus broadening the scope of the market. These trends are expected to transform the investment landscape, making it more accessible and efficient for a wider audience.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 25.1% |

Robo Advisory Software Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.