Market Analysis

In-depth Analysis of Retail Edge Computing Market Industry Landscape

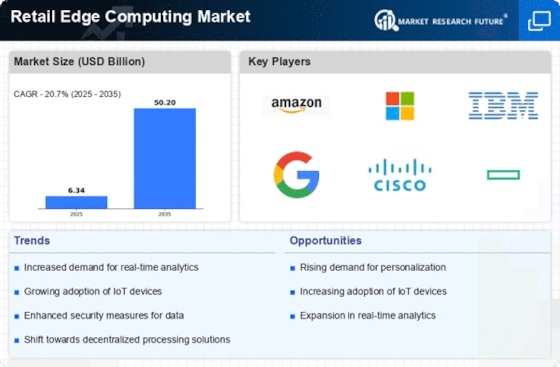

The Retail Edge Computing Market is continuously changing thanks to a dynamic set of drivers that work together to help it grow and develop. The major driver in this market is digitalization transforming retail industry and embracing advanced technologies. In doing so, businesses invest more into IT solutions that improve personal service, optimize functioning processes using real-time analytics based on decentralization approach provided by modern principles of edge computing moving closer to points where data is produced accelerating decision-making process up to 60 times faster than before. Technological innovation epitomizes everything about Retail Edge Computing Market today. This may involve concepts like smart shelves or AI-powered customer engagement or even real-time inventory management. It empowers the retailers with the capability of offering personalized experiences to their customers and carrying out operations in a more streamlined manner. The state of global economy plays a vital role in shaping the Retail Edge Computing Market. The economic crisis can influence brands’ choices regarding updating their IT infrastructure. When economies are growing, they may have money set aside for technology which improves customer service and operational effectiveness including edge computing. Conversely, during an economic slowdown, companies may pull back on spending influencing capital investments made in retail edge computing market. Retail Edge Computing Market is marked by critical aspects like regulatory compliance and data security. As retailers handle sensitive customer information, abiding by data protection regulations and ensuring edge computing solutions are secure becomes crucial. In this case, retailers consider solutions that comply with industry standards while providing strong security mechanisms aimed at guarding consumer data as well as maintaining trust among consumers. Retail edge computing market is heavily influenced by competitive landscape. This gives room to intense competitiveness as different vendors offer solutions. Scalability, ease of integration with existing retail systems, support for multiple applications and cost-effectiveness stand out as the main distinguishing factors that make retailers prefer certain edge computing solutions over others. The ability to continuously innovate and address unique challenges presented by the retail sector is one of the major aspects which keeps this market moving.

Leave a Comment