Rising Space Exploration Initiatives

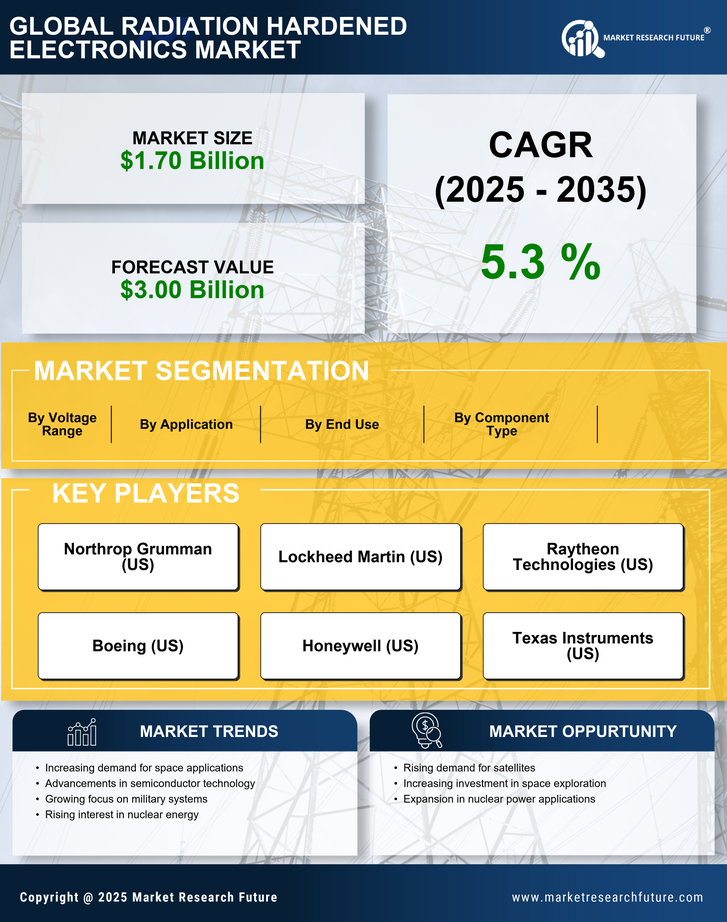

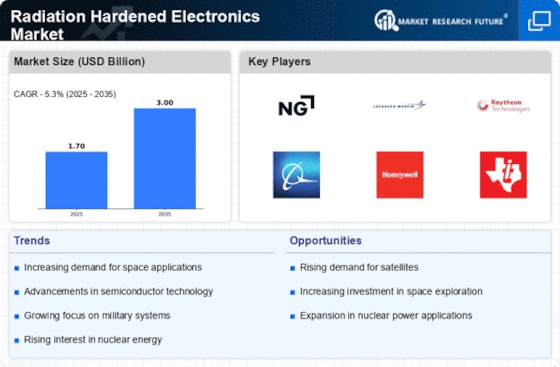

The Radiation Hardened Electronics Market is experiencing a notable surge due to the increasing number of space exploration initiatives. Governments and private entities are investing heavily in missions to Mars, lunar exploration, and satellite deployment. This trend necessitates the use of radiation hardened electronics to ensure the reliability and longevity of equipment in harsh space environments. For instance, the demand for radiation hardened components is projected to grow at a compound annual growth rate of approximately 8% over the next five years. As more missions are planned, the need for robust electronics that can withstand radiation exposure becomes paramount, thereby driving the market forward.

Expansion of Nuclear Power Generation

The expansion of nuclear power generation is significantly influencing the Radiation Hardened Electronics Market. As countries seek to diversify their energy sources and reduce carbon emissions, nuclear energy is gaining traction. This shift necessitates the use of radiation hardened electronics in control systems, monitoring equipment, and safety mechanisms within nuclear facilities. The market for these specialized components is expected to witness a growth rate of around 6% annually, driven by the increasing number of nuclear reactors being commissioned worldwide. The reliability of radiation hardened electronics is crucial in ensuring the safe operation of nuclear power plants, thus propelling market demand.

Growing Demand for Satellite Technology

The growing demand for satellite technology is a key factor influencing the Radiation Hardened Electronics Market. As satellite applications expand into telecommunications, earth observation, and global positioning systems, the need for reliable electronics that can endure radiation in space becomes increasingly important. The market for radiation hardened electronics is anticipated to grow at a rate of 9% per year, driven by the proliferation of small satellites and constellations. This trend underscores the necessity for robust components that ensure operational integrity in the challenging environment of space, thereby propelling the market forward.

Technological Advancements in Electronics

Technological advancements in electronics are playing a pivotal role in shaping the Radiation Hardened Electronics Market. Innovations in materials science and manufacturing processes are leading to the development of more efficient and reliable radiation hardened components. These advancements not only enhance performance but also reduce costs, making them more accessible to various sectors, including aerospace and defense. The market is projected to grow as new technologies emerge, with an estimated increase of 7% in the adoption of advanced radiation hardened electronics over the next few years. This trend indicates a shift towards more sophisticated applications, further driving market growth.

Increased Military Spending on Defense Systems

Increased military spending on defense systems is a significant driver for the Radiation Hardened Electronics Market. Nations are investing heavily in modernizing their defense capabilities, which includes the integration of advanced electronics in weapon systems, surveillance, and communication technologies. The demand for radiation hardened electronics is expected to rise as military applications require components that can withstand extreme conditions, including radiation exposure. With defense budgets projected to grow by approximately 5% annually, the market for radiation hardened electronics is likely to expand in tandem, reflecting the critical role these components play in national security.