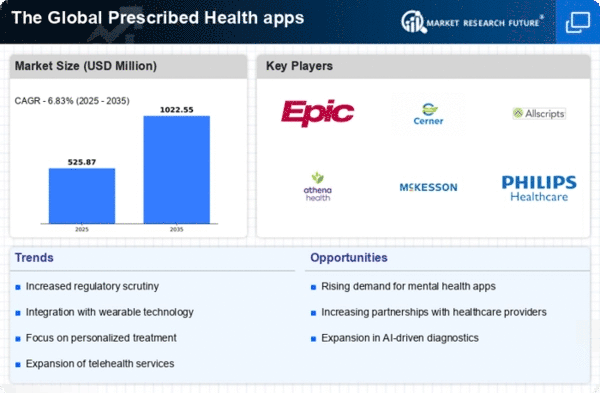

Market Growth Projections

The Global Prescribed Health Apps Market Industry is poised for substantial growth, with projections indicating a market value of 0.0 USD Billion in 2024 and an anticipated increase to 0.11 USD Billion by 2035. This growth trajectory suggests a burgeoning interest in prescribed health apps, driven by factors such as technological advancements, increased healthcare awareness, and the integration of telehealth services. The projected compound annual growth rate (CAGR) of 41.56% from 2025 to 2035 further underscores the potential for expansion within this sector. As the market evolves, it is likely to attract new entrants and innovations, shaping the future landscape of the Global Prescribed Health Apps Market Industry.

Integration with Telehealth Services

The integration of prescribed health apps with telehealth services significantly propels the Global Prescribed Health Apps Market Industry forward. As healthcare providers increasingly adopt telehealth solutions, the synergy between these platforms and health apps enhances patient access to care. Patients can seamlessly communicate with healthcare professionals while utilizing prescribed apps for monitoring their health conditions. This integration not only improves patient outcomes but also fosters adherence to treatment plans. The anticipated growth in this sector is underscored by a projected compound annual growth rate (CAGR) of 41.56% from 2025 to 2035, indicating a robust future for the Global Prescribed Health Apps Market Industry.

Regulatory Support and Standardization

Regulatory support and standardization are essential drivers of the Global Prescribed Health Apps Market Industry. Governments and health organizations are increasingly recognizing the importance of establishing guidelines and standards for health apps to ensure safety and efficacy. This regulatory framework fosters consumer trust and encourages healthcare providers to recommend prescribed health apps to patients. As regulations evolve, they are likely to create a more favorable environment for innovation and investment in the sector. The anticipated growth in the market, with projections reaching 0.11 USD Billion by 2035, suggests that regulatory support will play a crucial role in shaping the future of the Global Prescribed Health Apps Market Industry.

Increased Focus on Preventive Healthcare

The Global Prescribed Health Apps Market Industry is significantly influenced by the rising emphasis on preventive healthcare. As healthcare systems worldwide shift towards preventive measures, prescribed health apps play a crucial role in facilitating early detection and management of health issues. These apps empower users to monitor vital health metrics, thereby promoting proactive health management. The growing awareness of the benefits of preventive healthcare is likely to drive user adoption of these apps. With the market projected to reach 0.11 USD Billion by 2035, it is evident that the focus on preventive healthcare will continue to shape the landscape of the Global Prescribed Health Apps Market Industry.

Rising Demand for Personalized Healthcare

The Global Prescribed Health Apps Market Industry experiences a notable surge in demand for personalized healthcare solutions. As individuals increasingly seek tailored health management tools, prescribed health apps provide customized features that cater to specific health conditions and personal preferences. This trend is reflected in the growing number of users who prefer apps that offer personalized recommendations based on their health data. By 2024, the market is projected to reach 0.0 USD Billion, indicating a burgeoning interest in these technologies. The ability to track health metrics and receive personalized feedback enhances user engagement, thereby driving the growth of the Global Prescribed Health Apps Market Industry.

Technological Advancements in Mobile Health

Technological advancements in mobile health are pivotal in shaping the Global Prescribed Health Apps Market Industry. Innovations such as artificial intelligence, machine learning, and wearable technology enhance the functionality and user experience of prescribed health apps. These technologies enable more accurate health monitoring and data analysis, allowing users to gain insights into their health trends. As mobile health technology continues to evolve, it is expected to attract a broader user base, thereby expanding the market. The integration of advanced technologies is likely to contribute to the projected CAGR of 41.56% from 2025 to 2035, reflecting the dynamic nature of the Global Prescribed Health Apps Market Industry.